What are the guidelines behind the ERC20 standard?

The ERC20 is a standard for building tokens on the Ethereum blockchain. Before ERC20 tokens, cryptocurrency exchanges had to build custom bridges between platforms to support the exchange of any token. For this reason, six rules were created by an Ethereum developer named Fabian Vogelsteller and placed under the name ERC20, which means “ethereum request for comment.”

Before ERC20 tokens, cryptocurrency exchanges had to build custom bridges between platforms to support the exchange of any token.

The ERC20 standard is the foundation of each fully operational ERC20 contract. Such a smart contract can dispense tokens as well as control their supply and monitor their movement and balances.

Interoperability between smart contracts

In order for a token to be compatible with ERC20, at least the features and behavior specified by ERC20 need to be implemented. Further functionalities can be added by implementing functions that are not part of the standard.

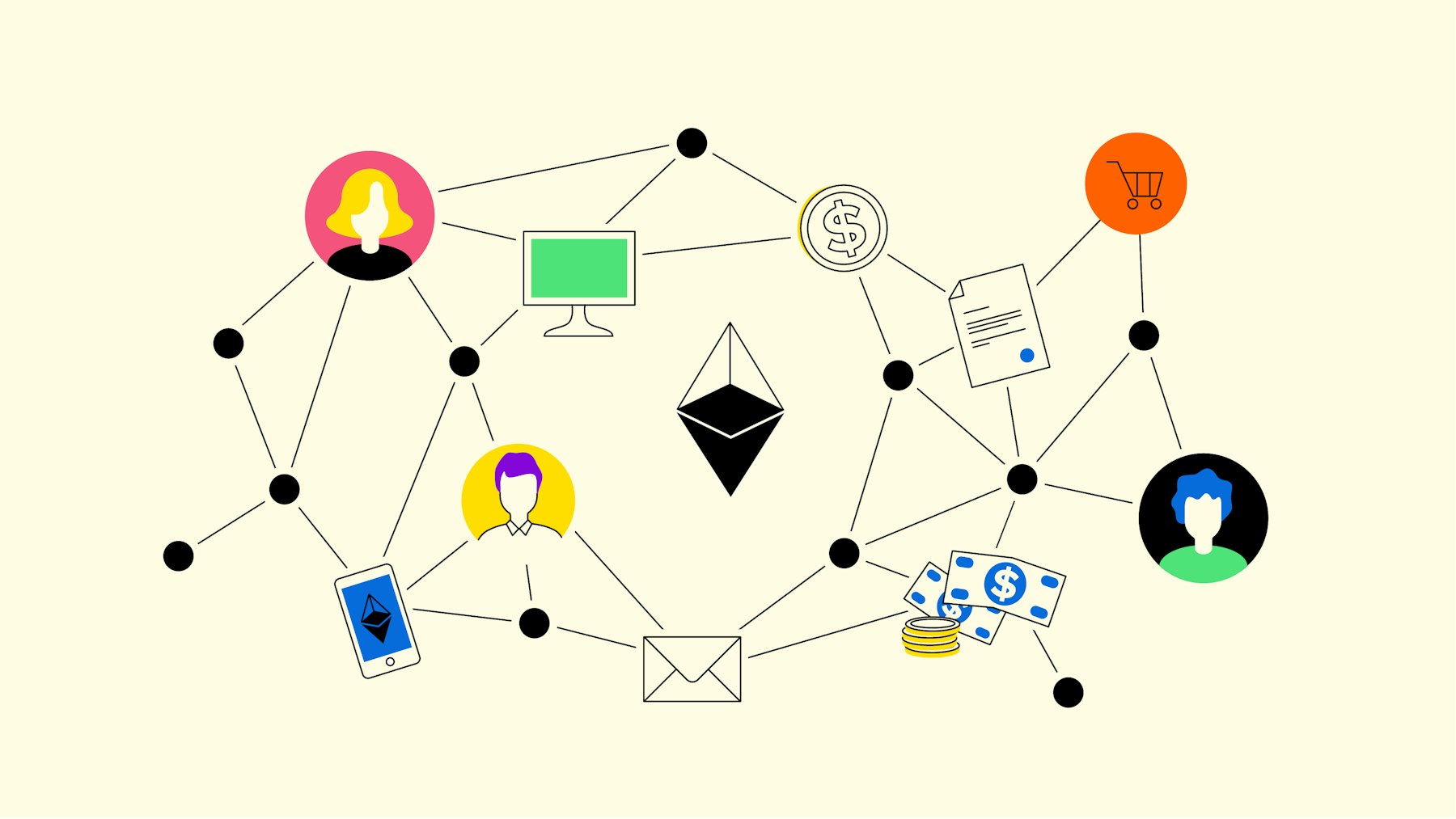

The main purpose of the guidelines behind the ERC20 standard is to promote interoperability between smart contracts. As a consequence, all infrastructure components such as user interfaces, exchanges and wallets can be connected to a contract in a predictable manner.

Interoperability itself is achieved because the ERC20 standard establishes an application programming interface (API). This way, third parties can access information and execute transactions and third-party apps can be coded for each ERC20 in a generic way without needing to be familiar with a specific token.

Changing the landscape of finance

What is the actual purpose of tokenising assets? For one, almost anything that can be owned, can also be tokenised - be it corporate shares, real estate, works of art, rights of use, vehicles...the list goes on.

Assets that have been tradable on stock exchanges are expanded by further tradable types of assets. Consequently, tokenisation also offers small and medium-sized enterprises access to funding without the need for intermediaries. Owing to this, a vast range of

ERC20 compliant tokens have been issued during Initial Coin Offerings (ICOs).

Almost anything that can be owned, can also be tokenised - be it corporate shares, real estate, works of art, rights of use, vehicles...the list goes on.