What is staking?

Explore our comprehensive guide to learn everything you need to know about staking – from the basic mechanisms like Proof of Stake (PoS) and Delegated Proof of Stake (DPoS) to the risks and prospects of this exciting aspect of the crypto world. Whether you're just starting to get interested in cryptocurrencies or are already an experienced investor, this article provides valuable insights and answers to questions about what staking is, how staking works, and its significance for cryptocurrencies.

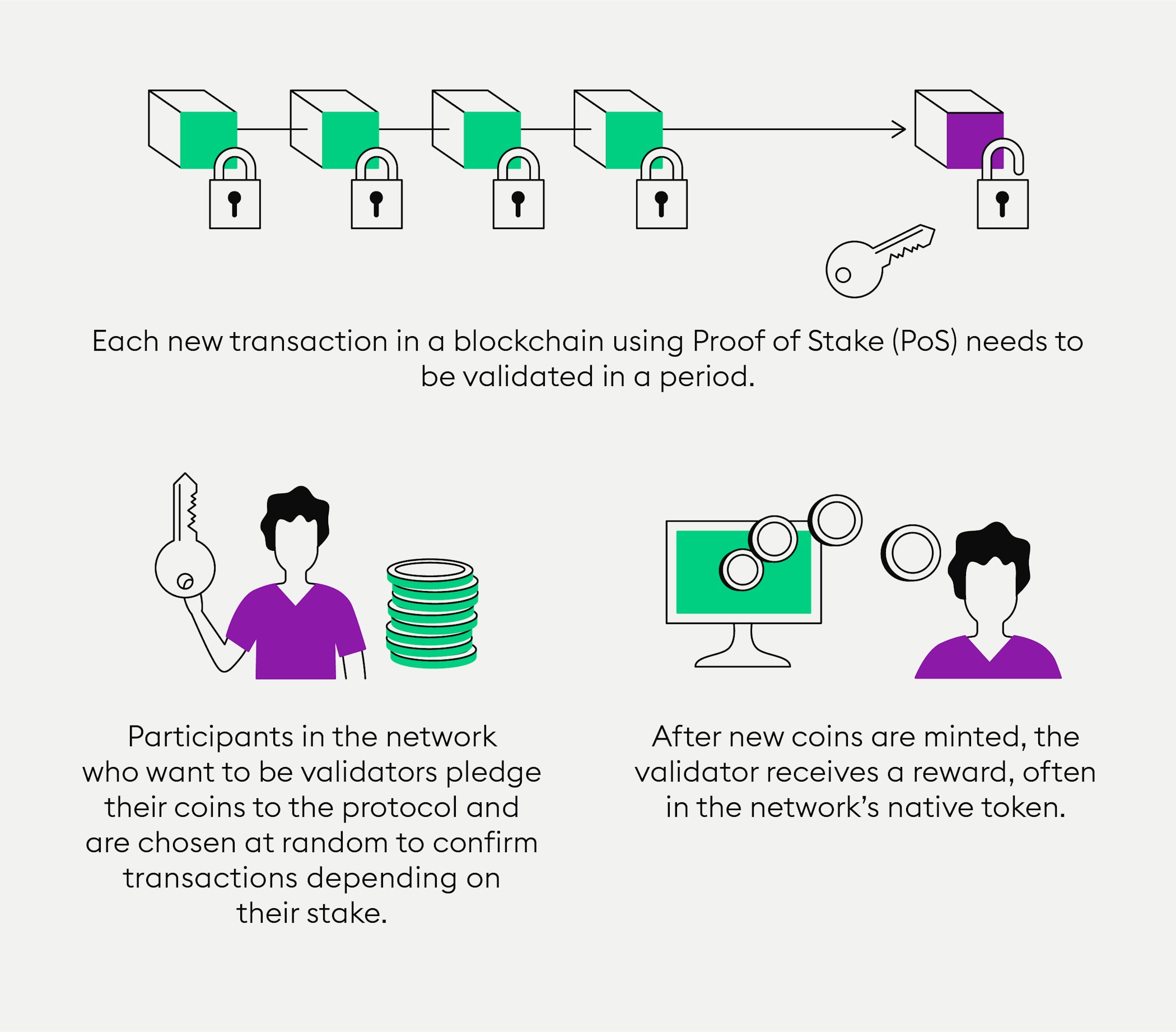

Consensus in a PoS network is achieved by validators who stake their coins - participants selected at random who prove a transaction to be true and accurate;

To become a validator, participants need to place at least a set amount of the network’s currency or native token in a wallet connected to its blockchain;

The original concept of staking is increasingly implemented by DeFi applications that enable interested parties to stake coins and to earn extra income.

What is staking?

Staking is a fascinating concept in the world of cryptocurrencies that supports the functioning of blockchain networks and offers investors a way to earn returns through their digital assets.

By definition, staking is a crypto process that allows network participants to earn rewards by locking their coins in wallets. These coins are then used to validate network transactions or as a liquidity source. Staking is applied in networks based on the Proof of Stake (PoS) consensus algorithm. Here, consensus is achieved through validators (participants who stake their coins and verify and confirm transactions). Participants become validators by depositing a set minimum amount of the cryptocurrency used in the network into their wallets. This step qualifies them to earn rewards for their staked assets.

When does staking begin?

The staking process begins as soon as validators set up their clients and ensure their setup is secure and up-to-date. They are then randomly selected by an algorithm to validate transaction blocks.

As these validators have a direct interest in the success of the network, staking promotes responsible and secure network behaviour and contributes to blockchain stability. Furthermore, the staked capital serves as a security deposit, which is at risk if validators behave dishonestly. This mechanism reinforces their commitment to acting honestly and in the network's best interest, as unethical behaviour can lead to the loss of their deposit.

Proof of Stake (PoS)

The reason why a Proof of Stake (PoS) network is considered a more environmentally friendly alternative to Proof of Work lies in its significantly reduced energy consumption. In the PoS system, it is not the quickest miner solving a computationally intensive task who is rewarded, but a validator who has staked a certain amount of network tokens and is selected randomly. This method requires significantly less computing power as it does not rely on energy-intensive mining operations. Moreover, the duration and amount of staked coins influence which validator is selected, adding a further dimension of fairness and security. This approach maximises energy efficiency and significantly reduces the environmental impact compared to Proof of Work networks.

In a PoS network, users can lock their tokens in a smart contract, for instance, to become validators. Validators in a network ensure that it is always available and up-to-date and that no participant abuses the network and takes control. The (often native) tokens are staked, meaning they are "locked" on the project's blockchain. The concept behind cryptocurrency staking is similar to a fixed deposit account with a traditional bank, through which users generate interest.

Delegated Proof of Stake (DPoS)

Delegated Proof of Stake (DPoS) networks attempt to expand participation in the PoS process with additional rules for selecting validators. This makes it more likely that people with fewer gestakt coins can still be picked to validate the next block. Validators are not chosen directly by all participants; instead, all participants receive voting rights proportional to their staked coins to elect representatives – known as witnesses or delegates. In DPoS networks, witnesses are responsible for block validation, while delegates oversee the network, monitor security, propose network changes, and initiate governance processes.

How does staking work?

Staking lets crypto holders earn rewards by locking their funds in a dedicated wallet. It works a bit like a traditional savings account: the locked funds generate staking rewards while locked. The size of your staking rewards usually depends on how much crypto you stake and for how long.

To start staking, you first need to set up the appropriate staking wallet for the respective project. It's important to understand that when staking, the coins are "delegated." This means they remain in your wallet and are not physically transferred. By delegating, you retain control over the assets while contributing to the network's security. This process can be achieved directly by running your own validator node or by holding the assets in a provider's wallet like Bitpanda.

Ready to earn staking rewards? Start today with Bitpanda Staking.

Get started nowImportant note: You should never transfer your coins to a wallet that does not belong to you. If a project asks you to transfer your coins to another wallet address, it is a scam, and your coins will be permanently lost.

Why is staking necessary?

Since validators have staked their crypto funds in the network and generate additional income by validating blocks, it makes sense that they are more interested in the network's success rather than its sabotage.

Increasingly, decentralised financial applications (DeFi), which offer decentralised financial services based on blockchain technology, are entering a realm traditionally dominated by banks and other central financial institutions. DeFi offers users the opportunity to deposit their assets into liquidity pools, which provides capital to other users and generates additional income, similar to interest payments from traditional banks.

Within the crypto community, staking is gaining importance, and this can be attributed to the activity of users as more and more want to earn profits with their crypto assets on DeFi platforms.

Can all cryptocurrencies be staked?

Not all cryptocurrencies offer the option for crypto staking. This feature is typically limited to currencies that use the Proof of Stake (PoS) consensus algorithm or similar mechanisms. Coins based on Proof of Work (PoW), like Bitcoin, cannot be staked, as transaction validation and block creation occur through mining.

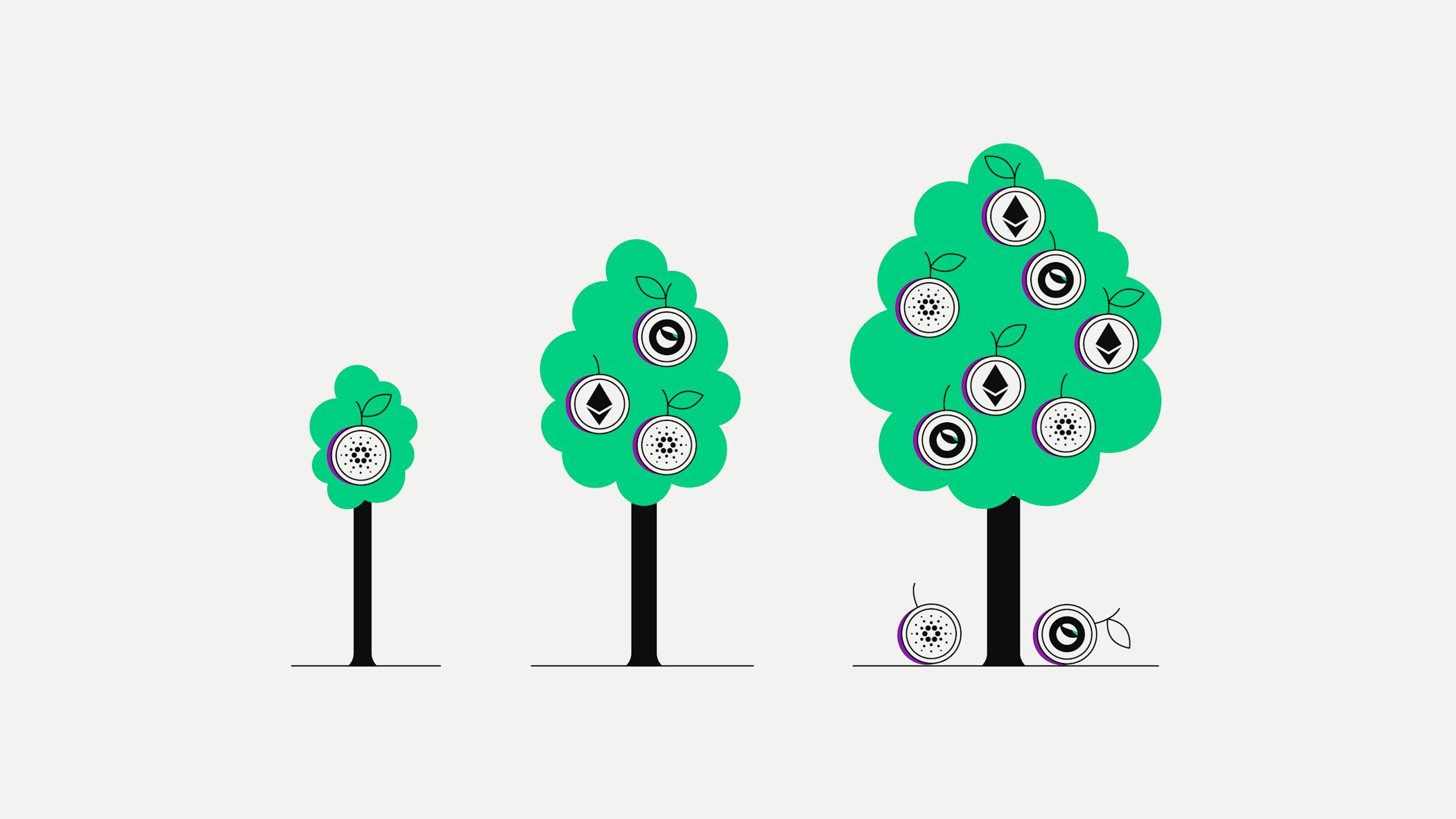

Staking is a feature implemented in various blockchain protocols to increase network security and reward users for participating in the network. Currencies like Ethereum 2.0, Cardano, and Tezos are prominent examples that support staking. Users can deposit their coins into a wallet compatible with the respective network to participate in block validation and earn rewards (staking rewards).

Each blockchain project defines its own staking rules. These may include a minimum amount of coins that need to be staked and a specific holding period. There is also the option to participate in staking pools, which makes it easier for users with smaller amounts to participate and increases the chance of regular rewards. Staking not only helps secure the network but also promotes active community participation.

Examples of cryptocurrencies that can be staked

The recent transition to Ethereum 2.0 (ETH) means that investors can stake their Ethereum coins to contribute to the network's security and operation while earning rewards.

Cardano (ADA) holders can contribute to network integrity through staking and receive rewards in the form of ADA, making the currency attractive for long-term investors.

Tezos (XTZ) allows users to participate in the network as “Bakers,” meaning they actively contribute to the network's development and security through staking.

Polkadot (DOT) staking contributes to network security that aims for interoperability between different blockchains.

Algorand (ALGO) offers an efficient staking system within its Pure Proof of Stake mechanism, characterised by low barriers to participation.

Want to learn more about possible staking cryptocurrencies? Then we recommend our article on crypto staking.

Are there risks in staking?

Staking is an attractive way to earn returns with cryptocurrencies, but it also carries risks. One of the main concerns is the so-called "lock-in risk." Staked coins cannot be traded for a set period, meaning investors cannot react to falling prices.

The security of the staking platform is also an important factor. Users must trust that their deposits are protected against hacking and theft. In case of a security breach, staked assets could be lost.

Another risk is slashing, where part of the staked coins can be forfeited if the validator violates the rules. This ensures that validators act in the network's best interest but can lead to losses for stakers.

Finally, it is important to consider the tax implications. Income generated from staking can be taxable, and the specific regulations vary by country and region.

The future of staking in the crypto ecosystem

Staking is poised for exciting developments as it is increasingly recognised as an eco-friendly alternative to traditional mining-based methods. Besides the lower environmental impact, staking also offers significantly increased speed, efficiency, and scalability compared to mining-based blockchains. Staking procedures are expected to become more user-friendly and accessible to a broader range of investors.

Particularly in decentralised finance (DeFi), staking is likely to play an increasingly important role, offering investors new ways to profitably use their digital assets. Innovations such as cross-chain staking could further enhance flexibility for investors by allowing assets to be staked across different blockchains.

With increased regulation and clearer frameworks, staking could become a common investment method for both private and institutional investors. This would further solidify its importance in the entire crypto ecosystem, highlighting the benefits of increased speed, efficiency, and scalability for a broader range of applications.

Frequently asked questions about staking

We answer the most frequently asked questions about staking.

How secure is staking?

The security of staking depends on several factors, including the reliability of the provider's staking platform and the stability of the respective crypto network. While the underlying blockchain technologies are considered secure, platforms where staking is conducted may be vulnerable to security risks. Careful research and the use of hardware wallets can minimise staking risk.

At Bitpanda Staking, we rely on state-of-the-art security mechanisms. Bitpanda offers a reliable staking platform that allows users to easily and securely stake their assets.

How is the return on staking calculated?

The return on staking is calculated based on the proportion of staked coins, the duration of staking, and the overall rate of issued rewards. Some platforms use the effective annual yield (APY) to indicate the return a user can expect over a year.

What are staking pools?

Staking pools are simply explained as associations of crypto investors who pool their resources to improve their chances of staking rewards. Individual investors contribute their coins to a common pool, which then functions as a large stake in the network.

This increases the likelihood of being selected as a validator and generating rewards, which are then distributed among the pool participants.

What does APY mean in staking?

The Annual Percentage Yield (APY) indicates the effective annual interest rate, expressed as a percentage, that investors can earn through staking. It takes into account the compound interest generated when staking rewards are reinvested to generate further rewards.

What is a lock-in period?

A lock-in period in staking is a time frame during which the staked coins cannot be moved or sold. This period ensures network security by guaranteeing that enough coins are available to validate transactions. The duration of a lock-in period can vary depending on the cryptocurrency and staking protocol.

More topics around staking

Do you want to dive deeper into the subject? Then take a look at our further articles on the topic and find out what really matters in staking.

This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.