Weaknesses in the public and private key method

The security of the public and private key principle depends not only on the encryption method but also on the correct handling of the keys. The greatest weakness lies in the private key – if it is lost or shared, access to one's cryptocurrency is permanently lost. Recovery is not possible in decentralised systems like the blockchain.

Security risks mainly arise from unsecured storage, untrusted devices or phishing attacks. If the private key is stored unencrypted or entered into manipulated apps, third parties may gain access to the wallet and its assets.

The public key can also have vulnerabilities – not through manipulation, but through traceability. Since all transactions on the blockchain are publicly visible, a known public key can be used to analyse activity.

Careful handling of the keys is essential – especially as the private key controls a cryptocurrency and cannot be replaced.

Wallet types and their encryption methods

Choosing the right wallet is essential for the security of your cryptocurrencies – especially regarding the management of private and public keys.

Hot wallets are connected to the internet and therefore convenient but more vulnerable to online attacks.

Cold wallets store the private key offline and are better suited for long-term storage.

Hardware wallets secure the private key on a physical device and offer high security.

Paper wallets consist of printed public and private keys and require careful physical storage.

Regardless of wallet type, private key encryption remains the central security feature. Only those who possess the corresponding private key can access the related cryptocurrencies. The blockchain ensures that each transaction is clearly authorised and traceable.

Hierarchical deterministic wallets, seed phrase and multi-signature wallets

In addition to traditional wallets, there are specialised solutions that offer added security and flexibility. These include hierarchical deterministic wallets (HD wallets) and multi-signature wallets.

HD wallets are based on a seed phrase – a series of words that serves as the starting point for generating many related keys. From this seed phrase, all relevant private and public keys in a wallet can easily be derived. This not only simplifies recovery but also backup, as one seed phrase is enough to access all wallet addresses.

Multi-signature wallets increase security by requiring multiple private keys to approve a transaction. Only when a defined number of key holders sign will the transaction be executed on the blockchain. This is particularly suitable for groups or companies that want to manage their cryptocurrencies collectively.

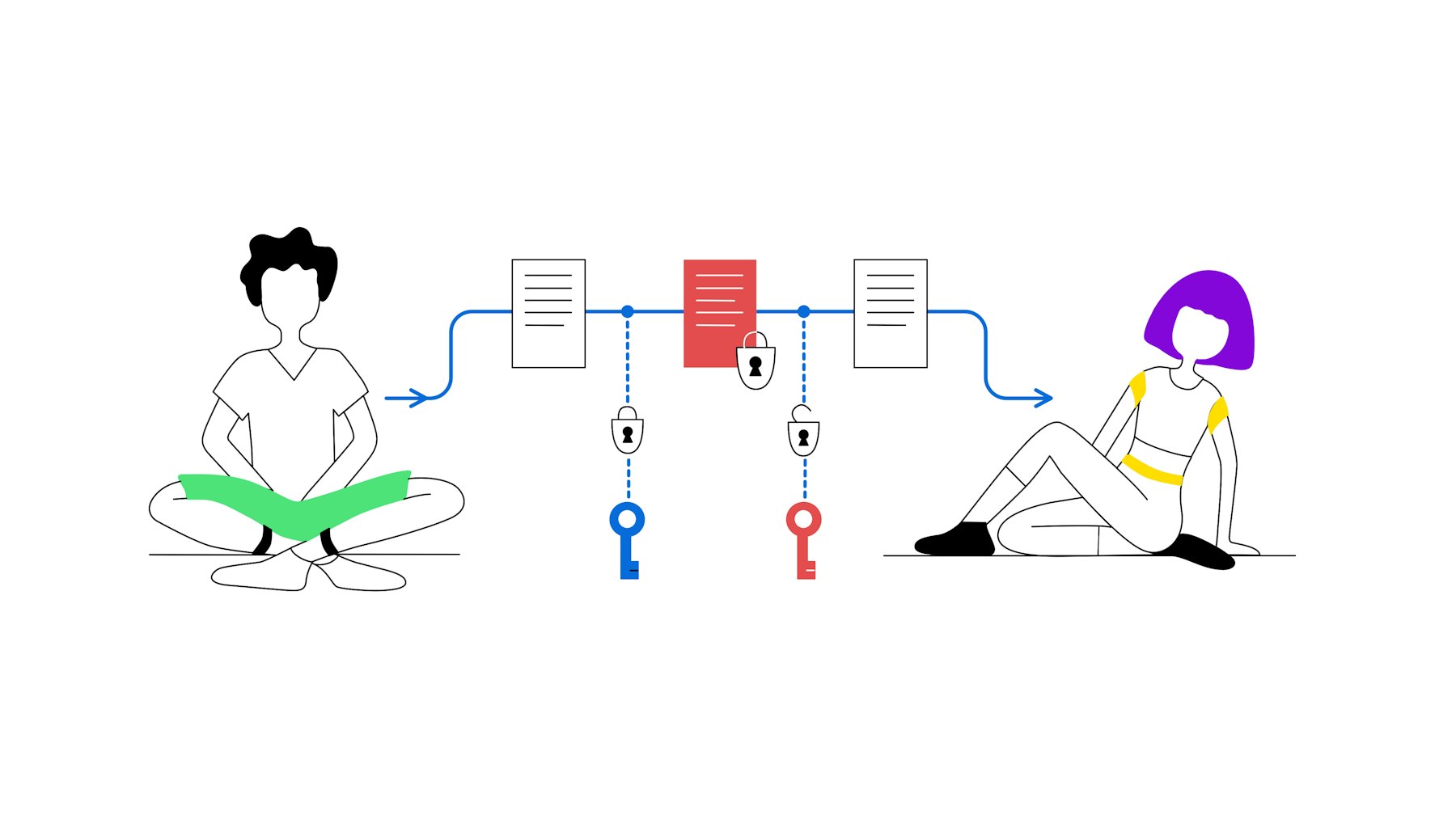

Both types of wallets use the public-private key method to clearly authorise transactions. While HD wallets enable structured key management, multi-signature wallets provide protection through distributed responsibility.

Conclusion: Trade cryptocurrencies securely thanks to public and private keys

Understanding public and private keys is essential for trading cryptocurrencies securely. Anyone trading Bitcoin or other cryptocurrencies should master the safe handling of public and private keys. The keys form the basis of security protocols in the crypto space and enable users to protect and control their digital assets. The private and public key method ensures that transactions are authenticated and assets securely stored.

For crypto traders, it makes sense to stay up to date on best security practices and apply them consistently. The world of cryptocurrencies is evolving rapidly, as are the methods to secure your investments. By continuing to educate yourself and using proven methods, you can fully benefit from cryptocurrencies while maintaining a high level of security.

Frequently asked questions about public keys and private keys

We answer the most common questions about public and private keys to give you a detailed insight into this topic.

Is private key encryption secure?

Yes – provided the private key is securely stored. Weaknesses in private key encryption usually result from insecure storage, phishing or sharing the key. If the private key is kept offline and protected from unauthorised access, it offers a very high level of security for managing cryptocurrencies.

Why is public key encryption considered more secure?

Public key encryption is considered more secure because the public key can be shared openly without revealing the private key. Asymmetric encryption makes it possible to encrypt data for a recipient or verify transactions without needing access to the private key. This separation ensures that an attacker cannot gain control over the cryptocurrency simply by accessing the public key. The security lies in the fact that the private key cannot be mathematically derived from the public key.

How can public and private keys be securely stored?

Private keys can be securely stored by saving them in a hardware wallet, creating a secure backup, e.g. on paper or a USB stick, and keeping them in a safe place such as a safe. Strong passwords and two-factor authentication should also be used to protect access.

Further topics around cryptocurrency

Want to deepen your knowledge of cryptocurrencies? Our detailed articles give you the chance to dive further into the world of digital currencies. In the Bitpanda Academy, you'll find a wide range of guides and tutorials offering exciting insights into topics like blockchain technology, crypto trading and safely managing digital assets.