What is a wallet and how do I get one?

When you dive into the world of cryptocurrencies, there is one term that will quickly and repeatedly come up: the term "wallet". But what exactly is a wallet, how does it work, and why is it so crucial for your crypto experience? We’ll explore this and more in this article.

A wallet is more than just a digital wallet. It acts as your access point to the blockchain – the heartbeat of the crypto world. With a wallet, you can securely store, manage and carry out transactions with crypto assets like Bitcoin. Although your cryptocurrencies are anchored in the blockchain, the wallet interacts directly with this ledger to give you control over your holdings.

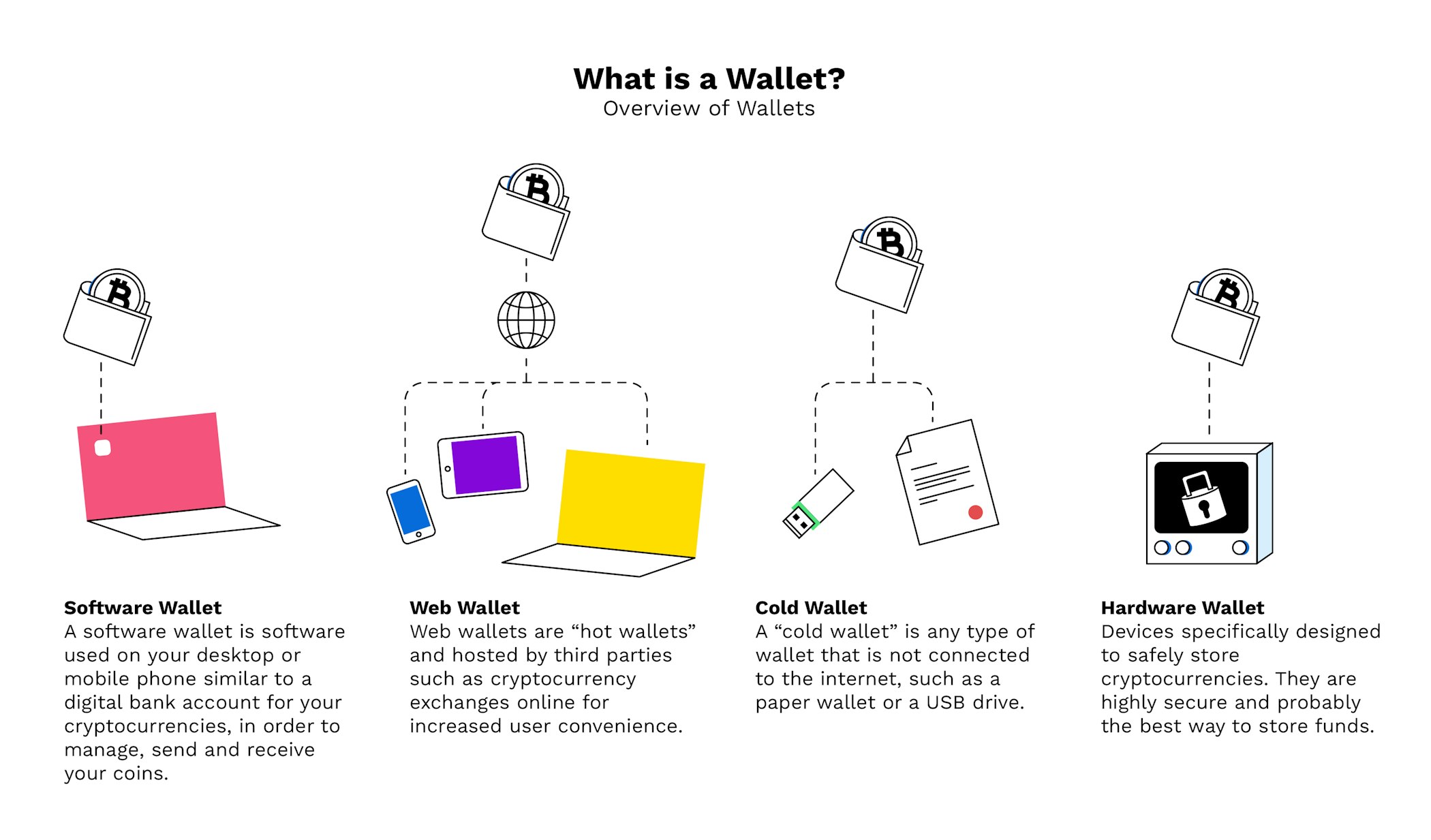

From online wallets that combine user-friendliness with quick access, to hardware wallets that offer the highest level of security, there is a variety of wallet types. Each type has its own functions and security features tailored to different user needs. Both public and private keys are required for transactions – and these are securely stored in your wallet.

In this article, we explain what a wallet is, how to create a wallet address, and what steps are necessary to securely manage your cryptocurrency funds.

What is a crypto wallet?

A wallet manages cryptocurrencies like Bitcoin, Ethereum, Solana, Litecoin, and other altcoins, but does not directly store them. What is actually in the wallet are the private and public keys that allow access to the addresses and thus the users' holdings. A wallet is not a physical wallet and bears no resemblance to a traditional wallet.

Instead, your wallet is a storage location for your addresses, public and private keys. You need these to access your public address on the blockchain and thus your cryptocurrencies like Bitcoin.

To be precise, a single wallet can contain multiple private keys. You can create as many wallets as you like. In fact, most cryptocurrency owners use multiple wallets to ensure maximum security for storing their various cryptocurrencies.

Note: Crypto wallets, specialised in the secure management of digital currencies, should not be confused with the multifunctional services of Google Pay and Apple Pay. The latter act as digital wallets that not only store credit cards, general cards and boarding passes but also manage car keys and tickets – all conveniently accessible via an app. In contrast, crypto wallets focus on a single purpose: managing cryptocurrencies. Everyday conveniences such as quick payments with Apple Pay or organising car keys, loyalty cards, boarding passes and credit cards in a single digital wallet are not their goal.

How does a wallet work?

A crypto wallet interacts with the blockchain to manage your cryptocurrencies by storing public and private keys, which are essential for sending and receiving cryptocurrencies like Bitcoin. Through these keys, the crypto wallet can verify transactions and enable users to access and secure their crypto assets.

A crypto wallet doesn't resemble your traditional wallet from services like Apple or Google Pay. Think of it more as a vault or treasure chamber. To access your assets, you need a key in the form of a password. If you lose your wallet's keys, you can no longer access your crypto wallet. Caution: If your keys are stolen, another person has access to your cryptocurrencies.

Anyone who knows the storage location (public address) and the corresponding password (private key) can access your crypto wallet. Knowing only the storage location isn't a problem, as the assets are securely stored on the blockchain. However, if you lose your keys or they are stolen, you can no longer access them, or another person is granted access to your balance. Therefore, you should protect your keys accordingly and store them in a safe place.

New to Bitpanda? Register your account today!

Sign up hereWhy are crypto wallets important?

Crypto wallets play an important role in the crypto world as they represent the interface between users and the blockchain. They are not only storage locations for digital currencies but also enable transactions on the blockchain. Every transaction, whether sending Bitcoin or interacting with a smart contract on Ethereum, begins and ends with a crypto wallet.

Exchange wallets, offered on crypto exchanges, are particularly useful for active traders and those who frequently conduct transactions. These wallets are usually custodial wallets, meaning the exchange holds the private keys and thus bears the responsibility for the security of the assets. They offer the convenience of conducting transactions and payments directly on the platform without the need to transfer funds from an external crypto wallet. This saves time and allows for quick responses to market changes.

How can you create a wallet?

Here's how you can set up your crypto wallet:

Choose the wallet type: Decide whether you want to create a hardware wallet, a software wallet or a paper wallet based on your security needs and frequency of use.

Download wallet software: For a software wallet, download the appropriate app to your mobile device or computer from a trusted provider. Alternatively, for online wallets, visit the provider’s website.

Installation and security measures: Follow the installation instructions and set up strong security measures such as a strong password and two-factor authentication (2FA).

Generate wallet address: After setup, a wallet address is automatically created. For additional security, you can also print out a paper wallet.

Create a backup: Secure your recovery phrase or private key in a safe place to restore access to your wallet in case of emergency.

After setting up your crypto wallet, you should familiarise yourself with its functions, especially how to manage addresses and conduct transactions. Security is of utmost priority: secure your recovery phrase, encrypt your wallet files and keep the software up to date. Practise transactions with small amounts and always keep your private keys secret to protect your crypto assets and privacy.

There are many different ways to store cryptocurrencies safely. Cryptocurrency owners can choose the wallet that best suits their needs.

We've summarised the different wallet types along with their advantages and disadvantages.

Custodial wallet

Custodial wallets are wallets where a third party retains control over your private keys. This type of wallet is often used by crypto exchanges, with the security and custody of the cryptocurrencies in the hands of the provider. This offers convenience but also means that you don't have full control over your crypto assets.

Advantages:

No need to secure private keys yourself – the provider takes care of it

You can often benefit from integrated services such as trading and swaps directly within the wallet

Custodial wallets are easy for beginners as more complex security measures are eliminated

Disadvantages:

You depend on the security and reliability of the provider

You have less control over your own cryptocurrencies

There's a risk of losing the cryptocurrency in case of security breaches of the provider

Note: Be aware that with custodial wallets, your crypto assets are legally owned by the wallet provider. Therefore, you should choose a provider like Bitpanda, which ensures secure asset protection through regular external security audits and adherence to industry standards.

Non-custodial wallet

Non-custodial wallets are wallets where you, as the user, have exclusive control over your private keys and thus over your cryptocurrencies. They offer more security and control, as no third party has access to your assets. However, they also require a higher level of responsibility for securing and managing your keys.

Advantages:

You have full control over the private keys and thus over the cryptocurrencies

There's a low risk that third parties can access the cryptocurrencies

Open source often allows code verification

Disadvantages:

You have full responsibility for the security of the private keys

It requires a higher level of technical understanding and care

If you lose the keys or backup information, there's no way to recover the cryptocurrencies

Note: Careful handling is important when using a non-custodial wallet. Ensure that your software is always up to date and consider using multi-signature wallets for additional security.

Cold wallet

Cold wallets offer one of the most secure methods for managing cryptocurrencies as they operate completely offline. This includes hardware wallets, paper wallets and any other form of storage medium that is not connected to the internet. Due to this offline nature, cold wallets are largely immune to online hacking attacks, phishing attempts and other cybersecurity risks that threaten online wallets.

Advantages:

High security through offline storage

The wallet is protected from online hacker attacks and malware

It provides a long-term storage solution for crypto assets

It reduces the risk of theft by third parties

Disadvantages:

The cold wallet is less user-friendly and less quickly accessible for regular trading

There are initial costs when purchasing hardware wallets

There's a risk of physical loss or damage to the storage medium

Initial configuration and recovery of assets are complex

Note: It's important to manage cold wallets carefully to ensure access to cryptocurrencies in case of loss or damage to the device. For maximum security, we recommend storing the cold wallet in a safe place and possibly depositing backups of the private keys or recovery information in multiple secure locations.

Hardware wallet

Hardware wallets offer a very high level of user-friendliness and security and are therefore often best suited for managing cryptocurrencies. The private keys are stored on a cryptographically secured hardware device and cannot be read in plaintext. Therefore, hacker attacks are almost impossible, even if a computer is infected with a virus.

Advantages:

Hardware wallets are user-friendly

They have very high security features

Secure storage of the device is possible

Convenient solutions for recovering assets in case of loss or damage to the hardware

Disadvantages:

Hardware wallets are not free

Used hardware wallets could be infected with malware

They may seem complicated at first use

There's no way to recover the assets in case of loss or theft of the device

Note: To ensure that hardware wallets have not been compromised before purchase, you should never buy used hardware wallets and always obtain them directly from trusted manufacturers.

Paper wallet / physical wallet

A paper wallet is a form of cold storage and refers to a physical document that contains your public and private keys, usually in the form of QR codes. Physical wallets can also take other forms, such as metal plates on which the keys are engraved. This type of wallet is, of course, always offline and therefore offers high security.

Advantages:

Depending on the type and creation of the paper wallet, there are high security features

It's inexpensive, simple and quick

Disadvantages:

If the printout with the private keys is lost, it cannot be recovered

It could be manipulated from the start if the computer is infected with malware

Note: It only takes a few minutes to create a paper wallet. Open source services are available online but generate the keys on the user's device. This means the keys are not sent to you over the internet.

Hot wallet

Hot wallets are crypto wallets that are constantly connected to the internet, allowing quick and convenient access to your cryptocurrencies – these include, for example, web wallets, mobile wallet apps and web-based desktop wallets. Due to their constant online connection, they are less secure against unauthorised access but offer higher user-friendliness for frequent trading and payments.

Advantages:

Hot wallets offer the easiest way to start crypto trading

You don't have to transfer funds when you want to sell them

A hot wallet is quick and inexpensive

There are high security features on trusted websites from providers like Bitpanda

Disadvantages:

Not every exchange offers wallet security at the latest technical standard

An exchange is inherently a "single point of failure" – if a component of the technical system fails, it can lead to a complete system failure

Convenience can lead users to no longer think about the security of management

You can't access your balance immediately

Note: Bitpanda stores all user assets in secure offline wallets that are state-of-the-art. In addition, users can secure their accounts using two-factor authentication (2FA). Users also have an overview of their active devices and sessions, can log out and close active sessions with another device. Furthermore, Bitpanda offers SSL encryption and protection against DDoS attacks. It's generally recommended to store only a small portion of your assets on an exchange and the majority of your coins in "cold storage" (offline).

Software wallet (desktop / mobile / online)

A software wallet offers high user-friendliness and high security features. Your balance is stored on a computer desktop or a mobile device such as a smartphone. You can access your cryptocurrency holdings immediately and have full control over your private keys, which are stored in a "single wallet file". For security reasons, this file is also encrypted, i.e., you can use a custom passphrase to access it.

Advantages:

A software wallet is easy to set up and use

It offers high security

You have control over private keys with it

Disadvantages:

A software wallet can be hacked if the computer or mobile device is lost

If your computer or smartphone is connected to the internet, your balance is online

Using public Wi-Fi networks is not safe for accessing your holdings

Note: Either you use a separate crypto wallet for each cryptocurrency you own, or you use a software wallet in which multiple cryptocurrencies can be stored.

Online wallet / web wallet

An online wallet is a type of software wallet that’s accessible via a web browser. It’s hosted on a server and allows users to access their cryptocurrencies over the internet. Although it's convenient and can be used from any internet-enabled device, it's generally considered less secure than other types of wallets, like desktop or hardware wallets, which offer offline storage of private keys.

Advantages:

You have immediate access to your cryptocurrencies over the internet

It’s integrated into many crypto exchanges or brokers for quick payments

An online wallet has user-friendly interfaces and is easy to set up

Disadvantages:

There’s a higher risk due to online storage of private keys

It’s vulnerable to hacking and phishing attacks

You might lose access if you forget login credentials or lack proper backups

Note: Maximise the security of your online wallet by conducting regular security audits and using features such as auto-logout timers and alerts for unfamiliar login attempts.

Web3 wallets: your key to the decentralised world

Web3 wallets let you do far more than manage cryptocurrencies—they're your gateway to decentralised applications (dApps), NFT marketplaces and DeFi protocols. Unlike traditional wallets, Web3 wallets act as a digital identity in the Web3 ecosystem. You can log into platforms with them seamlessly, without revealing personal data. Whether you're trading tokens, joining a DAO or collecting NFTs—Web3 wallets give you direct control over your assets without intermediaries.

For maximum control and security, make sure to use your private keys only on trusted devices and create regular security backups.

If you want to explore the Web3 world further, we recommend our articles What is Web3?, where you’ll learn how the new decentralised internet works, and What is a Web3 wallet?, which shows you how to interact directly with the blockchain and manage your digital identity.

Explore Bitpanda Web3 - Your gateway to the future of the internet.

Get startedBitcoin wallet & more: cryptocurrencies and their own wallets

In the world of cryptocurrencies, choosing the right wallet is crucial. A Bitcoin wallet, designed specifically for the first and most well-known cryptocurrency—Bitcoin (BTC)—offers tailored functions optimised for BTC’s management and security. Just as Bitcoin wallets are tuned for BTC, there are also dedicated wallets for other cryptocurrencies like Ethereum (ETH).

Using specific wallets for different cryptocurrencies offers several advantages. Firstly, they provide better compatibility with the respective blockchain protocols, which leads to smoother transactions. Additionally, dedicated wallets often support unique features of the cryptocurrency in question, such as smart contracts with Ethereum.

Another key aspect is security: wallets developed for specific cryptocurrencies may include security features tailored to that blockchain’s unique risks and attack vectors. For example, many Bitcoin wallets offer advanced security features like multi-signature verification and hierarchical deterministic (HD) address generation to help keep funds safe.

Finally, the user experience can be enhanced by using a dedicated wallet for your crypto assets. The interfaces of these crypto wallets are often more user-friendly and provide better overviews of payments and balances. Whether you're setting up a Bitcoin (BTC) wallet or another crypto wallet, dedicated software helps optimise your crypto experience.

How wallet security is maintained

Security is paramount when managing cryptocurrencies. To best protect your digital assets, take care when creating a Bitcoin wallet or any other crypto wallet. Here are some tried and tested methods for keeping your crypto wallets secure:

Careful selection when creating: Choose an established and trusted software or hardware provider. The provider should meet high security standards and have strong user reviews.

Favour offline storage: Use cold storage options like hardware wallets for the bulk of your coins and tokens. These wallets aren’t constantly connected to the internet, reducing the risk of online theft.

Activate security features: Enable all available security measures, such as two-factor authentication and multi-signature protection mechanisms. These extra steps make unauthorised access harder.

Back up the recovery phrase: The recovery phrase allows you to restore access to your crypto wallet if you lose access. Store it safely—ideally offline, such as in a safe or other secure place.

Regular updates and checks: Keep your crypto wallet software up to date to benefit from the latest security patches. Regularly check and adjust your wallet settings as needed.

Education and awareness: Stay informed about the latest security trends and be alert to phishing and other scams.

A look into the future of wallets

Modern crypto wallets are no longer just storage for cryptocurrencies—they're evolving into multifunctional platforms. In future, they may transform how we think about and manage finance through integration with DeFi ecosystems and support for multi-signature transactions. These technologies enhance security while offering new opportunities to earn returns or participate in governance systems.

Further innovations might include seamless interfaces between different blockchain networks and more automation through smart contracts. In the dynamic crypto world, continual learning is key to staying up to date and fully taking advantage of evolving wallet features.

For more information about multi-signature wallets and DeFi, visit our Bitpanda Academy.

Conclusion: how to choose and set up the right wallet

Choosing the right crypto wallet is a personal decision based on how you use cryptocurrencies—and it's unrelated to traditional digital wallets like Apple Pay, which manage car keys and various cards. Consider security, convenience, the features you need and how often you'll access your cryptocurrencies. For daily payments, exchange wallets are practical, while hardware wallets offer long-term security.

After selecting your crypto wallet, many providers offer guides to help you set up and use your wallet securely. Remember, the cryptocurrency ecosystem is constantly evolving. That’s why it's important to keep learning and act responsibly when using your crypto wallet and managing your assets.

Frequently asked questions about wallets

We answer the most common questions about crypto wallets to give you a complete overview.

Where can I get a wallet?

You can obtain crypto wallets from various sources, including crypto exchanges, official project websites or app stores. Hardware wallets are typically sold by manufacturers or authorised dealers. You can set up your Bitpanda wallet, for example, via our Bitpanda Smart Investment App.

Do I need new wallets for new cryptocurrencies?

Not necessarily. Many crypto wallets support multiple cryptocurrencies. However, the wallet must be compatible with the specific cryptocurrency. Some new or less common cryptocurrencies might require a dedicated wallet.

What is a wallet address?

A wallet address is a string of characters assigned to your crypto wallet and serves as the receiving address for cryptocurrency payments. It works similarly to an account number in traditional banking.

How can I create a wallet address?

A wallet address is usually generated automatically when you create a crypto wallet. For software or online wallets, this is done by the wallet app or service. For hardware wallets, the address is generated by the device once it's set up.

How many coins can a wallet hold?

The storage capacity of a crypto wallet and the number of coins it can hold depend on the type of wallet, its technical specifications and the type of coins. Hardware wallets generally support a large number of cryptocurrencies, while software wallets vary.

Custodial wallets, like those on crypto exchanges, usually offer unlimited storage—but you don’t retain control over your private keys.

More topics about cryptocurrency

Interested in exploring cryptocurrencies more deeply? We recommend checking out our additional articles to dive further into the world of digital assets:

Are you ready to buy cryptocurrencies?

Get started nowThis article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.