How does compound interest work?

Compound interest is money earned on top of interest that was already earned. Not only do you earn simple interest on your initial deposit in an investment, but you can also earn additional interest on top of what you earned in the first phase of your investment.

Investors rely on the power of compound interest to increase their assets over the long term.

Compound interest brings you higher returns on investments and savings but in rare cases may also work against you if you are the party paying interest on a loan.

Compounding is a type of exponential growth similar to a “snowball effect”.

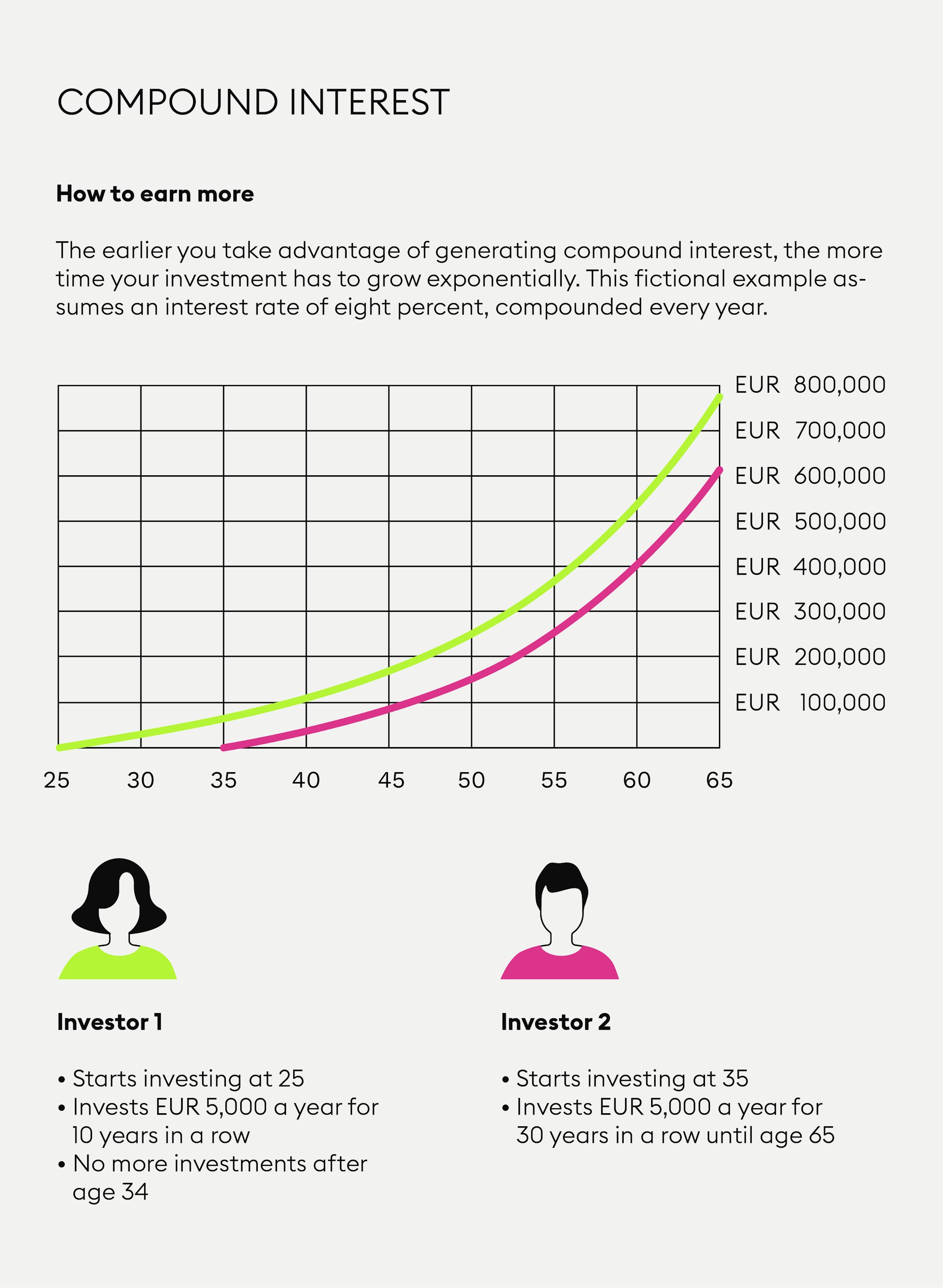

The concept of compound interest is closely aligned with one of the basic principles of sustainable investing, namely to ensure the long-term growth of your assets. Thinking of the long term may be directly opposed to the predispositions of human nature, but savvy investors generate the self-awareness to monitor their emotions and take advantage of time in developing healthy investment habits.

What are the benefits of compound interest?

Compound interest is one of the most important concepts in personal money management as it will not only help you to generate higher yields from your investments but understanding the principle may also prevent you from going into debt.

The term “compound interest” is based on the definition of the term “interest”, meaning that compound interest can only be accumulated if simple interest is accumulated in the first place. If you don’t receive interest for depositing money in a savings vehicle, such as a savings account, the principle of compound interest does not apply.

Keeping your money in your account

By receiving interest on an investment, your investment increases. If you do not withdraw this additional amount generated by interest or by dividend payments, your now increased investment will keep earning interest. Owing to the fact that your investment has increased, the interest is now generated based on this new, higher amount.

Therefore, the interest received generates more interest. This is the principle behind compound interest. Needless to say, the key to profit from compound interest is keeping your money and the interest you earned on it in your account and not withdrawing it. If you do not withdraw the earnings your investment has generated, your now increased investment will keep earning compound interest.

New to Bitpanda? Register your account today!

Sign up hereHow to profit from compound interest

If you have invested in assets that exponentially grow on their own and generate gains, you will profit from compound interest.

Let’s look at an example of an investment in a savings account in the amount of EUR 100,000, which you have invested in at an interest rate of 0.5 percent per year. After the first year, you will receive a total of EUR 500 in interest, consequently increasing your sum to EUR 100,500. In the second year you receive another 0.5 percent in interest. The table below shows you the effects of compound interest using this example:

TABLE

EUR 500 in interest in the first year

EUR 502.50 in interest in the second year

EUR 505.01 in interest in the third year

EUR 507.54 in interest in the fourth year

EUR 510.08 in interest in the fifth year

EUR 512.63 in interest in the sixth year

EUR 515.19 in interest in the seventh year

EUR 517.76 in the eighth year

EUR 520.35 in the ninth year

EUR 522.96 in the tenth year

Note that this basic concept also applies to stocks and ETFs when you reinvest capital gains and dividend payouts.

When is compound interest not a good thing?

Most of the time, compound interest should be positive for you as an investor. Different legal frameworks around the globe have provisions in place to protect debtors with maximum interest rates, provisions against usury - lending money at unreasonably high interest rates - and bans on charging compound interest in many cases. Charging compound interest is forbidden in the case of most credit transactions.

However, compound interest does not always only work for you. In some situations it may also cause disadvantages, like in instances where compounding also applies to negative interest. Some banks may charge you compound interest for overdrawing your bank account - when you withdraw money from your account and the balance on your account goes below zero.

Why overdrawing your bank account does not pay off

In case you overdraw your bank account, compound interest would begin to accumulate on the negative balance at a certain point. When you overdraw your bank account, compound interest would accrue on the negative balance consisting of your overdraft and the interest your bank charges you.

In this case, compound interest would put you at a disadvantage, because, for the second year, you will pay interest on top of the sum which you owe for the first year of overdrawing your account, plus on top of the interest for the initial amount. Therefore, such an amount can spiral upwards rather quickly, so make sure to avoid overdrawing your bank account.

What to watch out for before you get a savings account

A word of caution: you do not automatically receive compound interest for every type of savings account.

For instance, there is a difference between so-called overnight deposits and fixed-term deposits. Depending on the type of savings account, your bank may move the simple interest generated and credit the amount to your reference account, such as the account where you receive your salary, in which case you will not receive any compound interest. Remember: your increased investment will only keep earning compound interest if you do not withdraw the earnings your investment has generated.

So make sure to find out how your interest is credited. Will it be moved to your bank account or can you generate compound interest by leaving your money in your investment account so your profit continues to earn interest? Make sure you pay close attention when you open your savings account to ensure you benefit from compound interest - and don’t forget to find out the compound interest rate.

This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.