What is inflation?

Inflation means that you get less for the same amount of money you needed before. The prices of goods and services rise in price while your money’s purchasing power decreases. There are many theories and sometimes opposing views about what actually causes inflation and its effects on the economy.

During a demand-pull inflation, demand is increased due to higher private and government spending.

Cost-Push inflation happens because of a price increase during manufacture of goods that ultimately increases the market price to buyers.

Built-In inflation leads to rising prices as a result of suppliers raising their prices.

In today’s scientific view, the mainstream agreement is that inflation depends on the growth of the money supply relative to economic growth - inflation is the result once money is “printed” faster than it is demanded.

An extreme form of inflation is hyperinflation which can happen when governments create too much money.

What is inflation?

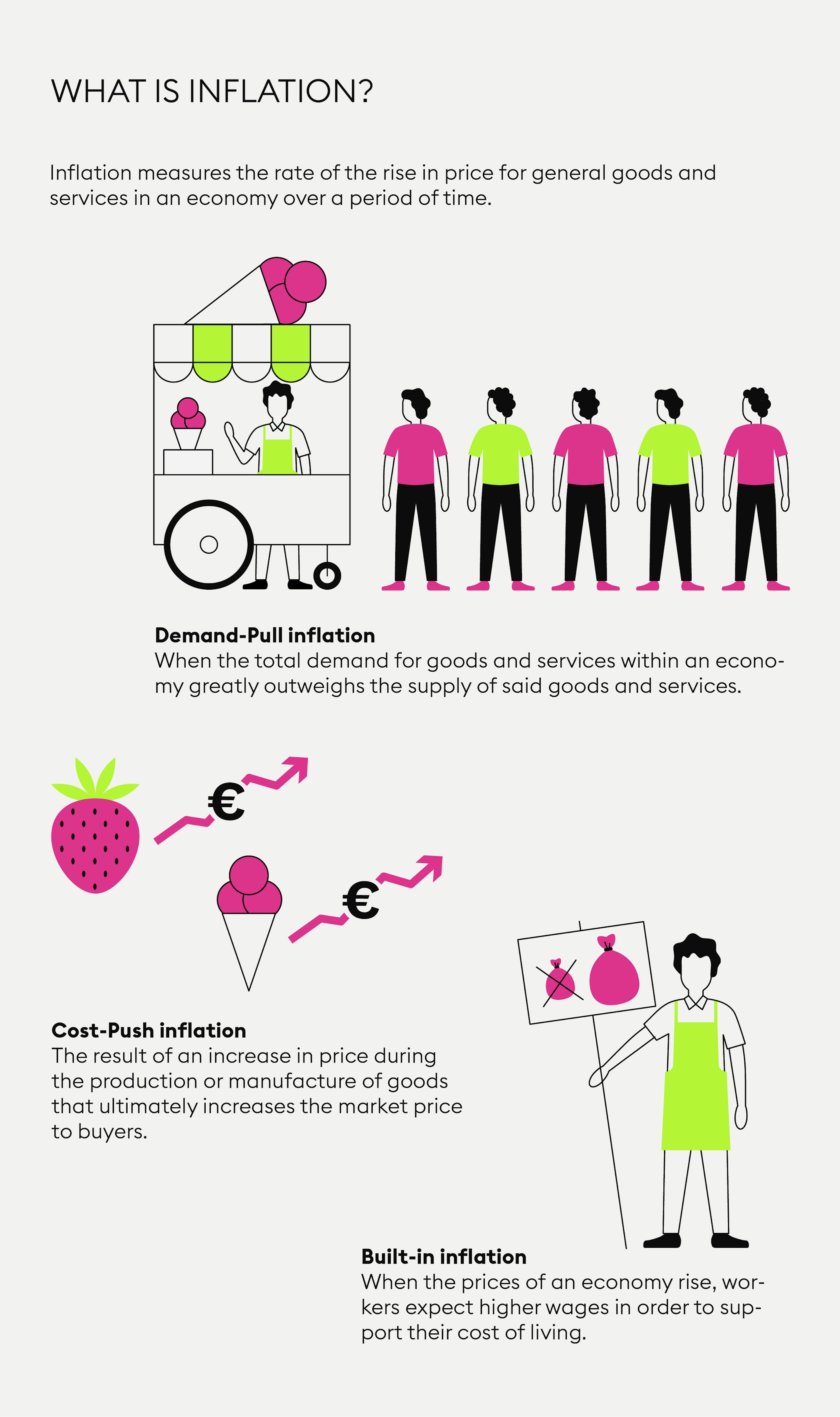

In simple terms, inflation measures the rate of price increase in the economy for general goods, services and many other areas. As prices increase around us, a certain amount of money will allow you to purchase fewer services and goods than before. Such a development impacts the general cost of living for many of us and can become a problem when it leads to the deceleration of economic growth.

What causes inflation?

Throughout history, the economy has been subject to periodic economic changes caused by inflation. The reasons and effects of inflation are disputed, but some popular distinctions are Demand-Pull inflation, Cost-Push inflation and Built-In inflation.

What is Demand-Pull inflation?

Demand-Pull inflation is a result of an imbalance between demand and supply and it’s the most common cause of inflation. When the total demand for goods and services by the public is much higher than the supply of said goods and services, then a gap is created. If many consumers want to buy certain goods, this results in higher prices and, in the end, leads to an overall higher cost of living for everyone.

This development often happens during an economic upswing. A rise in employment in an economy means more disposable income to the general public, which leads to higher spending. This increase in demand ultimately leads to a rise in the price of goods and services.

What is Cost-Push inflation?

Cost-Push inflation is the result of an increase in price during the production or manufacture of goods. If goods cost more to manufacture, this ultimately increases the market price for buyers. For example, a company has to increase the labour cost of manufacturing their sunglasses by hiring more employees and getting more expensive materials. Since the company had to pay a higher cost for the production of the sunglasses, they increased the market price in order to make a profit from selling them.

What is Built-In inflation?

Built-In inflation occurs when prices in an economy rise and workers expect higher wages in order to support their cost of living. This causes a slippery slope of problems because higher wages lead to higher demand, higher demand leads to higher market prices which results in, you guessed it, inflation.

Why is inflation important for cash holders?

Inflation can be seen as either a good or bad thing, depending on your position. Inflation may not mean positive news for those who only save cash in their bank account, as inflation devalues their cash holdings, i.e. your funds end up with less purchasing power and won’t generate returns if the rate of inflation is higher than the interest rate for the savings account.

Why is inflation important for investors?

Inflation often favours those who invest. Investors with tangible assets such as stocks or commodities hope for inflation in markets that affect their investments, as it increases demand and they can then sell their holdings for a higher price. In turn, buyers of said assets would have to spend more money on what was once a lot cheaper. That is why, as an investor, it is a good idea to invest a fixed monthly amount of your disposable income in financial products of your choice to avoid your savings being the target of inflation.

New to Bitpanda? Register your account today!

Sign up hereDISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.