What is a stock?

A stock represents ownership of a share in a publicly listed company and is usually a medium to long-term investment. Investors purchase stocks when they believe the company’s value will increase over time so that they can then sell their shares for a profit.

A stock represents a share of a company, i.e, a small portion of that company.

Investors make money from stocks by selling them for more than what they originally paid for it.

There are two types of shareholders: common stockholders and preferred stockholders.

What are stocks?

A stock represents a share (a small unit of ownership) of a company. Investors purchase stocks or shares when they believe the value of the company will eventually increase. If that happens, the investor will receive a percentage of the company's income in the form of dividends, and the value of the stock will exceed the purchase price of the original investment.

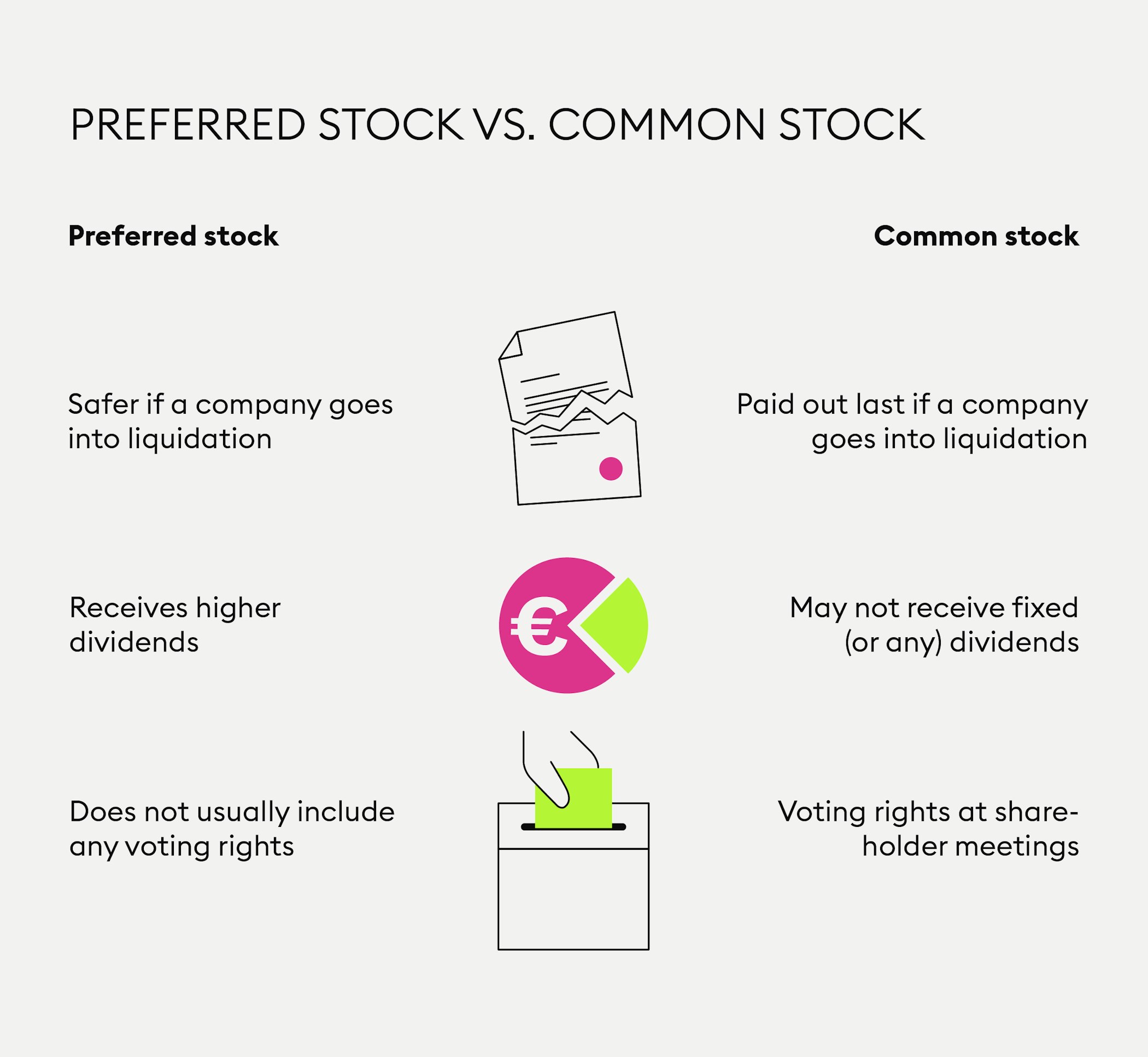

There are two types of stocks: common stocks and preferred stocks. Both have their advantages and disadvantages:

What are preferred stocks?

Preferred stockholders do not usually have any voting rights in company matters. They do, however, receive priority over common stockholders in case the company goes into liquidation. Also, holders of preferred stock usually receive fixed or set dividends before holders of common stock do. This attracts investors who seek stability and potential steady cash flow in the future.

What are common stocks?

Common stockholders are usually entitled to vote at shareholder meetings on matters of company development. Holders of common stock may receive dividend payments, however dividends are not guaranteed and the payments are not fixed.

If the company goes bankrupt, common stockholders cannot claim the capital they invested in the company until creditors, bondholders and preferred shareholders have received their share first. This factor may add some risk. However, it has been proven that in the long run, common stocks usually receive higher rewards than preferred stocks and bonds.

How to earn money from stocks

Earning money from stocks depends completely on how much money you plan to invest. Investing in stocks is generally considered more high-risk than other assets, but it also yields higher rewards. Investors make money from stocks by selling their holdings for a higher amount than what they originally paid.

Once the stock price and, consequently, the market capitalisation of a company increases while the investor owns shares, they can then sell them for more than the original purchase price.

New to Bitpanda? Register your account today!

Sign up hereWhat are dividends?

Another way to earn money from stocks is through dividends. Dividends are small shares of the company’s earnings which are distributed to shareholders. Some companies pay their stockholders dividends quarterly or monthly, while some companies don’t pay dividends at all.

How much does a share cost?

The number of shares of stock you buy will depend on your budget. The amount you spend depends on the share price at the time of your purchase and how much you want to buy.

However, innovative brokers and exchanges are allowing you to start investing in stocks for amounts starting from €1. Therefore, it entirely depends on your budget, the amount you are ready to spend and which broker you want to use. An important thing to mention is that you should always do your research on the company you intend to buy stocks from and never spend more than you can afford to lose.

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.