What are multi-signature wallets and how do they work?

In some cases, it is desirable to have multiple levels of approval for spending cryptocurrencies. As the name suggests, multi-signature wallets require authorisation of transactions through multiple keys, meaning that a group of users is required to sign to approve a transaction.

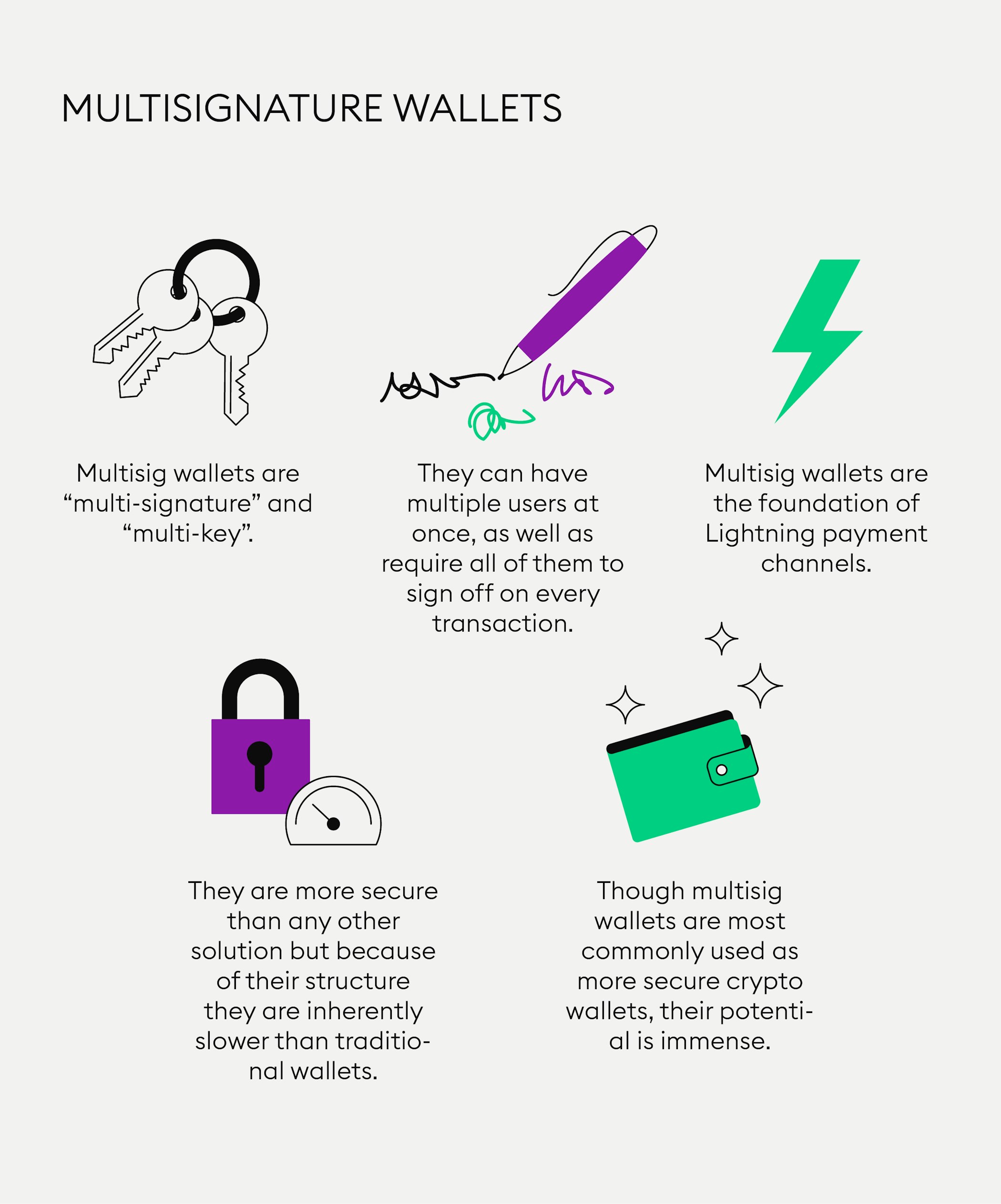

Multi-signature wallets or “multisig wallets” for short, are a type of cryptocurrency wallet for which at least two private keys are needed to sign a transaction.

Imagine a secure locker with two locks and two keys held by two parties that can only be opened if both provide their keys, thus ensuring that one party is not able to open the box without the other party’s permission.

In the Bitcoin Lightning Network, a multi-signature transaction is required for opening a payment channel between two parties, where each partner locks a certain amount of bitcoins into a multisig wallet and then receives one of two required keys.

In this article, you are going to learn about multi-signature wallets and why they are used.

Like you learned in the Bitpanda Academy for beginners, a cryptocurrency wallet is a digital or analog storage solution that a crypto holder needs to access their cryptocurrencies. Fundamentally speaking, two elements are essential in a (single signature) crypto wallet mechanic.

The first is a public key, which is like a bank account number. The hashed version of a public key is the owner’s wallet address. To access and control the funds, a user needs a private key which is like the PIN code for that bank account. For this reason, it is crucial that only the crypto holder knows the private key - to ensure sole access and full control of the crypto holdings associated with this address.

Where do single-signature crypto wallets fall short?

Always bear in mind that crypto wallet safety should be of paramount importance, with funds kept offline and inaccessible to third parties in cold wallets being the safest way of storage.

However, with any type of traditional single signature (“singlesig”) crypto wallet, the theoretical risk still exists that if someone is able to steal a private key from your computer (aka a “hot wallet”) or even your cold wallet (offline storage), they could possibly establish ownership over your crypto.

If you know that a traditional cryptocurrency wallet has one private key, then you can think of it as a “single key” wallet or a wallet that requires a “single signature” to authorise transactions.

What are multisig wallets?

If you know that a traditional cryptocurrency wallet has one private key, then you can think of it as a “single key” wallet or a wallet that requires a “single signature” to authorise cryptocurrency transactions. Multisig wallets on the other hand require at least two private keys to sign a transaction, making them more secure than single signature wallets. What does this mean in practice?

First of all, multisig wallets don’t only bring increased security to teams and organisations that need to manage shared assets and execute multiple party transactions but also to individual crypto holders: one crypto user can also hold multiple private keys (“signatures”) for a wallet, further mitigating the risk of someone accessing their crypto holdings if several signatures are required as some multisig wallets offer integration of private keys of other wallets.

And then multisig wallets are a highly secure crypto storage option for groups or organisations that are spread across the world looking to administer funds in trustless environments where the involved parties don’t know each other in person.

How can I create a multisig wallet?

In general, setting up a multisig wallet is not much more complicated than creating a singlesig wallet. After selecting your co-signers or how many people you want to share the wallet with, you just add participants to a wallet with a few clicks and also select how many signatures you want to be required for a transaction to be valid, which is synonymous with how many private keys your wallet will have. Of course you can also use those as extra layers of security if you are using the multisig wallet on your own.

Multisig wallets are a highly secure crypto storage option for groups or organisations that are spread across the world looking to administer funds in trustless environments where the involved parties don’t know each other in person.

Also, all co-signers need to know the password called the “master public key” to access a shared multisig wallet. The difference between the master public key and a traditional public key is that you need to share it with everyone who is your co-signer to make the wallet truly “multisig.” After co-signers have agreed to confirm that they want to “join”, the multisig wallet will indicate how many participants need to sign a transaction for it to be acceptable.

New to Bitpanda? Register your account today!

Sign up hereAdvantages and disadvantages of multisig wallets

Besides making a wallet more difficult to hack because of multiple private keys, the advantages of multisig wallets are obvious. Passwords are stored in several locations or on different devices, thus reducing dependence on one device. Using a multisig wallet also reduces dependence on one party as co-signers can step in if something happens.

Ultimately, this is a disadvantage of multisig wallets at the same time. If the entire group of signers decides to commit a fraudulent transaction, it may prove very difficult to get funds back. Additionally, if a multi-sig wallet is only used by two parties, there is always an inherent risk that one party blocks the transactions instigated by the other party if they disagree with them for some reason. This is the reason why a “2-of-3” scheme is a more secure option. In this case, two parties transact, but a third party is involved as a mediator with the sole responsibility of dealing with any sort of controversy that could arise.

Also, transactions may take longer as there are more signatures involved. While transactions from so-called threshold signature wallets that start with a single signature by a single trusted party and then divide the private key between the number of participants and appear on the blockchain as one standard single signature, the size of a transaction is considerably increased by several signatures instead of one. For this reason, singlesig transactions receive preferential treatment by miners and can lead to delays in processing, higher gas fees on the Ethereum blockchain and higher transaction fees for multisig transactions.

What are multisig wallets used for?

As of now, multisig wallets are currently either used as more secure versions of regular wallets or as building blocks of the Lightning Network.

Like you learned in the Bitpanda Academy’s intermediate section, the Bitcoin Lightning Network serves as second-layer scaling solution to the Bitcoin network. In the Lightning network, participants can create payment channels between two parties where an initial deposit is made which can then be used to send Lightning Network transactions up to a certain limit, with the balance being updated with every transaction.

As these transactions are not stored in the blockchain, they scale up the network. As the consent of both parties is required for each transaction, Lightning wallets are multisig with each party holding their own private key. Bitcoin users regularly transacting small amounts of BTC benefit from almost instantaneous transaction settlement and lower fees.

This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.