What are market orders, limit orders, stop limit orders?

When trading securities and cryptocurrencies, different order types and order additions play a central role. They regulate how and when the orders - i.e. the orders to buy or sell certain assets - are executed. In this guide, we explore the different order types on the stock exchange and in crypto trading. We explain how these order types work, their advantages and disadvantages, and how you can best use them for your trading strategy.

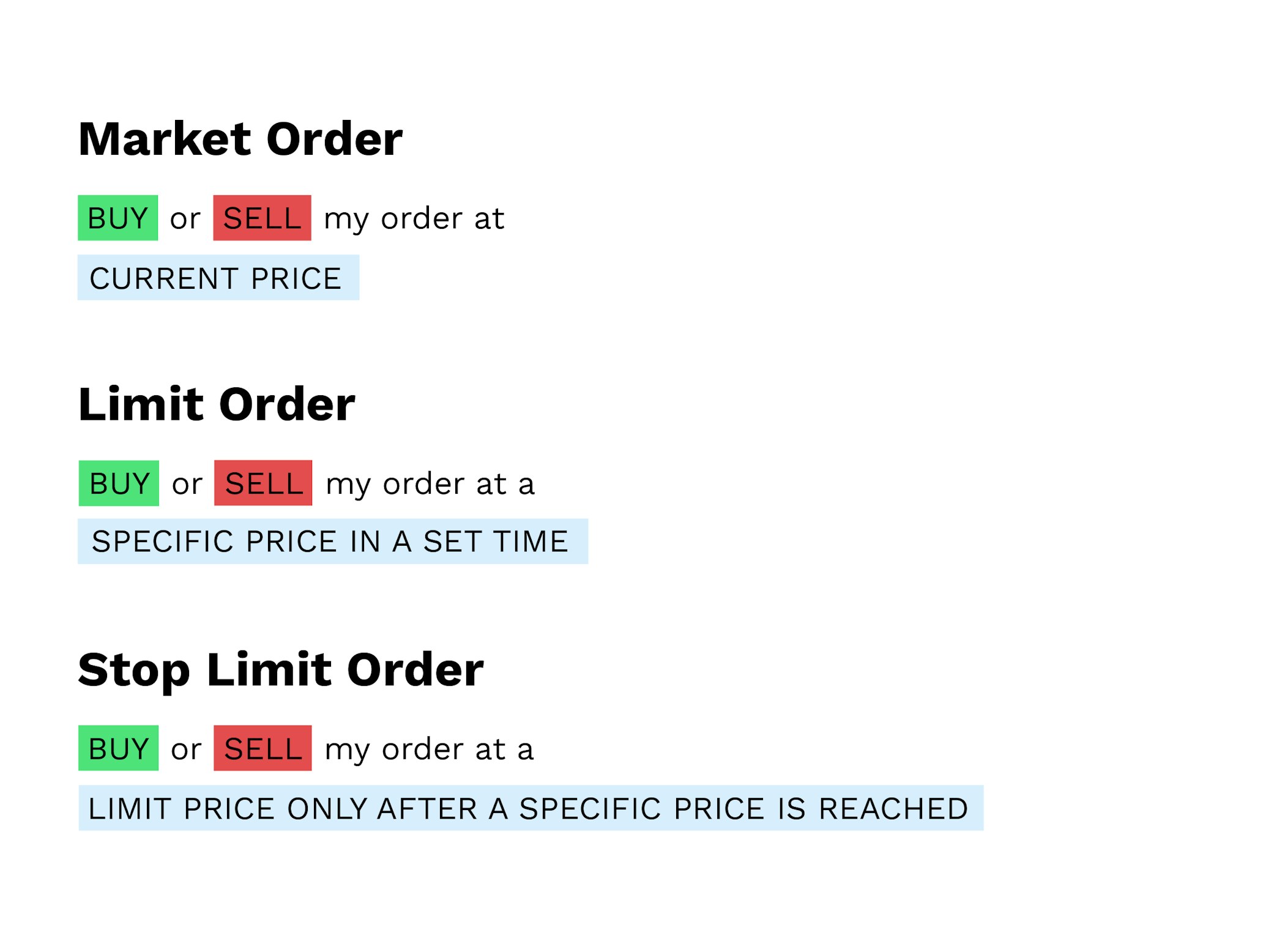

Order types determine the execution of an order in trading securities and cryptocurrencies and represent important tools for trading. In addition to the most common order types such as market orders, limit orders and stop limit orders, there are other options for buy and sell orders.

The special features of crypto trading include margin trading and timing. So, if you want to optimise your trading strategy and minimise risks, choosing the right order type is key.

What is a trade order?

A trade order is an investor's order to a broker or exchange to buy or sell cryptocurrencies, securities or other financial instruments at a fixed price or at the best available conditions. It forms the basis for trading on stock exchanges.

Trade orders are crucial to implementing investors' trading strategies and achieving their goals. They ensure that transactions are executed at the best available market conditions or specific rates set by the investor. This process can be done either manually or automated via trading platforms and algorithms.

If you are interested in trading different assets, understanding the different order types and how they work can help you trade successfully in the financial markets.

Order types on stock exchanges and brokers

In addition to various order conditions, there are the following order types:

Market Order

Limit Order

Stop Limit Order

Stop Loss Order

Trailing Stop Order

If Done Order

One Cancels the Other (OCO)

Next Order

Market order

The market order is a direct buy order, which is an instruction to the broker to buy or sell a security immediately. This type of order has the highest priority and is executed immediately at the best available price. This means that the broker executes the order immediately as soon as it is placed, without waiting for a certain price to be reached.

The main advantage of a market order is that it is executed immediately. This makes it particularly suitable in situations where the speed of purchase is more important than the price. It is also easy to understand and place, as there are no price limits to set. A disadvantage is that, particularly in volatile markets, the execution price may differ from the expected price due to rapid changes in the price. Since there is no price guarantee, unexpected costs may arise.

Limit order

A limit order is an instruction to buy or sell an asset such as a security at a set price or better on the stock exchange. This type of order offers investors more control over the price and is only executed when the market value reaches or exceeds the set limit. When buying, this means that the order will only be executed at the set limit price or cheaper, while when selling, it will only be executed at the limit price or higher.

This allows investors to avoid unexpected costs caused by sudden price changes. However, a disadvantage is that the order may not be executed if the market price does not reach the limit. In addition, placing this type of order requires careful market observation and strategic considerations.

Stop-loss order

A stop-loss order is an instruction to sell an asset when the price reaches or falls below a specified stop price. This type of order is designed to limit losses. Once the specified value is reached, the order is immediately executed as a market order, i.e. a direct buy order, at the best available price.

The advantage of a stop-loss order is risk management. It ensures that a security is sold before it continues to lose value, in order to limit any losses. Another advantage of this type of order is automation: investors can rely on automatic execution as soon as the stop price is reached. A major disadvantage, however, is that the actual selling price can be significantly lower than the set stop price in highly volatile markets. In addition, there is no guarantee that the order will be executed at least at a similar level to the stop price.

Stop-limit order

The stop-limit order is one of the combined order types. As such, it combines the functions of a stop order and a limit order. It is executed as soon as, for example, the price of a security reaches a specified stop price —but only at a certain limit price or better. As soon as the stop price is reached, the stop-limit order is converted into a limit order. This is then only executed at the specified limit price or better.

The advantage of a stop-limit order is the controlled execution. Investors can precisely determine the maximum acceptable loss or profit. In addition, this type of order allows more flexibility and adaptability to different market situations. However, stop-limit orders are more complicated than simple market or limit orders and require a good understanding of the underlying mechanisms. There is also the risk that the order will not be executed if the market price does not reach the limit.

Stop-buy order

A stop-buy order is used to buy an asset once the price reaches or exceeds a certain stop price. This is useful for entering a rising market. Once the stop price is reached, the stop-buy order is converted to the market order type and is immediately executed at the best available price.

A stop-buy order allows investors to enter the market when a certain price level is exceeded, thereby reacting to rising market trends. However, there is no guarantee that the order will be executed at the expected price. In volatile markets, the final purchase price can therefore differ significantly from the set stop price.

Trailing stop order

The trailing stop order is a dynamic tool for investors to automatically adjust the stop price when the market price moves favourably. It is used to lock in profits while increasing the potential for further profits. The stop price of a trailing stop order follows the market price at a set distance defined by the investor. If the market price rises, the stop price also moves upward. If the market price falls, the stop price remains unchanged. Once the market price reaches the stop price, the trailing stop order is converted to a market order.

The advantage of a trailing stop order is the ability to lock in profits while maintaining the potential for further profits. In addition, this type of order automatically adapts to market movements, allowing for a flexible trading strategy. However, trailing stop orders are extremely complex and require a good overview of how the markets work and the correct setting of the trailing distance. As already explained for other order types, the final price upon execution can deviate from the desired stop price, especially in highly volatile markets.

If-done order

An if-done order is another example of a combined order type. The second order is activated only when the first order has been fully executed. This order type is often used to automatically place a stop loss or limit order after a market order has been executed. The if-done Order contains a primary (first) order and a secondary (second) order. If the primary order is successful, the secondary order is automatically activated. This allows for a flexible and automatic trading strategy that takes into account different market conditions.

By reducing the need for manual intervention, the if-done order gives investors a distinct advantage when trading. It also enables more complex trading strategies by linking orders. Due to its complexity, this type of order requires investors to be familiar with market mechanics and place orders correctly. In addition, the secondary order remains inactive until the primary order is executed.

One cancels the other (OCO)

The one cancels the other (OCO) order consists of two orders. The execution of one of the two orders results in the immediate cancellation of the other. This order type is used to minimise investment risks and maximise profits by combining two opposing trading strategies. With an OCO order, the investor places two orders at the same time, a buy and a sell order. When one of the two orders is executed, the other is automatically cancelled. This offers flexibility and control as the investor is prepared for both rising and falling market movements.

A key advantage of an OCO order is that it eliminates the risk of manually cancelled orders and at the same time ensures that only one of the two orders is executed, depending on the market. However, this type of order is complex and requires a good knowledge of the market processes. Rapid changes in prices in volatile markets can also lead to unexpected results in order execution.

Next order

A Next Order is similar to an If Done Order. It is an instruction that only becomes active after a previous order has been fully executed. In contrast to the if-done order, where the second order is only executed after the first order has been successfully executed, the execution of the Next Order is independent of the result of the previous order.

This allows investors to plan and execute a sequence of transactions while reducing the need for constant market monitoring and manual intervention. A disadvantage of this type of order is its high complexity. Investors should have a good understanding of market mechanisms and plan the sequence and conditions of orders carefully.

Key aspects of crypto trading - margin trading and timing

There are a few special features in crypto trading that investors should be aware of. One of these is margin trading. Since the prices of cryptocurrencies are very volatile, gains and losses in the price regularly occur within a few minutes. The markets for cryptocurrencies are relatively small compared to other financial markets, which means that so-called ‘whales’ (people who trade with significant amounts of cryptocurrencies) can influence the entire market.

In margin trading, investors buy and sell assets in large quantities using their own and borrowed funds to profit from volatility. This method allows them to maximise potential profits. However, margin trading also carries a higher risk as losses can be magnified by using borrowed capital. Therefore, a careful risk management strategy is essential.

Another unique feature of crypto trading is timing. Due to high volatility and rapid price fluctuations, also known as ‘whipsaws’, it is crucial to find the right timing for trades. When placing stop orders, traders must pay attention to timing to ensure that rapid price fluctuations do not have a negative impact.

Instead of placing stop loss orders, it may sometimes be more advisable to continuously monitor price developments and manually follow the set exit price. This allows you to react flexibly to market movements and minimise potential losses. With a well-thought-out timing strategy, the chances of successful trades are increased, while the risks from market volatility are reduced.

Are you ready to buy cryptocurrencies?

Get started nowDifferent order types for different strategies

The various order types offer investors at brokers and stock exchanges flexible tools to optimally implement their individual trading strategies. Each order type - be it market, limit, stop loss or one of the combined order types such as stop limit or one cancels the other (OCO) - has specific advantages and disadvantages that can have different effects depending on the market situation and asset class.

Market orders are particularly suitable for transactions that need to be executed quickly, while limit orders offer more control over the execution price. Stop loss and trailing stop orders help limit losses and lock in profits, but require a good understanding of market volatility.

Different markets and asset classes require a differentiated approach. What makes sense in stock trading can offer different risks and opportunities in crypto trading. In the volatile cryptocurrency market, for example, timing is crucial, while more stable market conditions prevail in traditional stock trading.

Overall, it is worth understanding the different sell and buy orders and using them in a targeted manner to optimise your own trading strategy. A sound knowledge of how the different orders work and where to best use them is essential for successful trading.

Bitpanda Limit Orders

Want to plan and execute trades with more precision? Bitpanda Limit Orders give you the tools to have greater control over your investment strategy.

Our new feature blends the control of limit orders with the automation of stop-loss orders. You can set your buying and selling prices* not just above or below the market price, but on both sides. This allows you to secure potential profits and manage any anticipated losses.

How does it all work?

Buy limit orders

Expecting a price rise? Set a buy limit order above the current price to join the rally.

Predicting a price drop? Set a buy limit order below the current price to buy the dip.

Example: If Bitcoin’s market price is €60,000, you can set a buy limit order at €58,000 to buy the dip. At the same time, you can also set a buy limit order for an above-market price – €62,000 for example – if you want to join a future rally.

Sell limit orders

To set a profit target - Set a sell limit order above the current price to cash out at your desired price.

To protect against losses - Set a sell limit order below the current price to sell if the price falls.

Example: If Bitcoin’s market price is €60,000, you can set a sell limit order at €62,000 to lock in gains if the price rises. Or set a sell limit order for below market price – €58,000 for example – to cover any potential losses.

This dual approach gives you more control and can help you capitalise on market movements or limit losses.

Other topics related to cryptocurrencies

Are you interested in investment and crypto topics? In our Bitpanda Academy you will find numerous lessons on blockchains, investments in stocks, ETFs and cryptos as well as many other areas. Whether you are a beginner, advanced or expert: everything is included, from initial research to in-depth security topics.

Disclaimer

*Bitpanda Limit Order is executed at the best available price, which could be higher or lower than the target price, especially in volatile markets. The final execution price may differ from the specified target price. It is important to understand this risk when placing limit orders. This article is distributed for informational purposes, and it is not to be construed as an offer or recommendation. It does not constitute and cannot replace investment advice. Bitpanda does not make any representations or warranties as to the accuracy and completeness of any information contained herein. Investing carries risks. You could lose all the money you invest.

New to Bitpanda? Register your account today!

Sign up hereDISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.