What are fractional shares?

A fractional share is a smaller portion of one share. It means a company share is split into smaller portions for investors who don’t wish to buy or cannot afford to buy one whole stock. Buying fractional shares is great for novice investors or everyday investors who want to diversify their portfolio and reduce risk.

Investors can buy a small portion of a share of a company.

Fractional shares cost the fraction of a price of one share.

Fractional shares add flexibility to your spending and are great for diversifying your investment portfolio.

*Until recently, investing in fractional stocks was only possible in the United States of America. Now, a few providers also offer fractional stocks in Europe via different setups like derivatives.

What is a fractional share?

Buying a whole share of a company can be very expensive, which is why fractional shares offer an attractive option to new investors just beginning to invest, simply because they are more affordable.

Imagine a whole share like a cake. A fractional share would be like taking just a slice of that cake. So investing in fractional shares means you are only buying a fraction (aka a smaller portion) instead of buying a whole thing. For average investors, this is more cost-effective than saving up a lot of money to spend on one stock, meaning you can invest with a small budget and that you don’t need high amounts to buy stock of a company.

What are the advantages of fractional shares?

Let’s say you want to buy a stock or share of a company in the hope of gaining income from their profits in the future. So, for example, you want to buy one Amazon stock, which is valued at around $3,000 (USD) right now. Unfortunately, the average person does not have an extra $3,000 lying around that they’re willing or able to possibly lose. Wouldn't it be nice if you could just buy a portion of a share instead, something proportional to how much you can afford? That’s exactly what fractional shares are for. Some brokers allow you to invest in a share from as little as one dollar.

Fractional shares add flexibility

The great thing about fractional shares is that you are able to purchase stocks that you normally could not afford. This adds a lot of flexibility to choose where you want to invest, no matter the company. It is true some brokers do not offer fractional shares which is why it’s important to do your research when searching for an investment platform.

New to Bitpanda? Register your account today!

Sign up hereFractional shares fit into your budget

Investing in fractional shares is easy to pencil into your budget which means you don’t have to worry about putting aside a lot of cash. You are able to put your disposable income into the market almost immediately. For example, you could invest in a share of a stock with the amount of money you would usually spend on a takeaway coffee.

Can fractional shares be profitable?

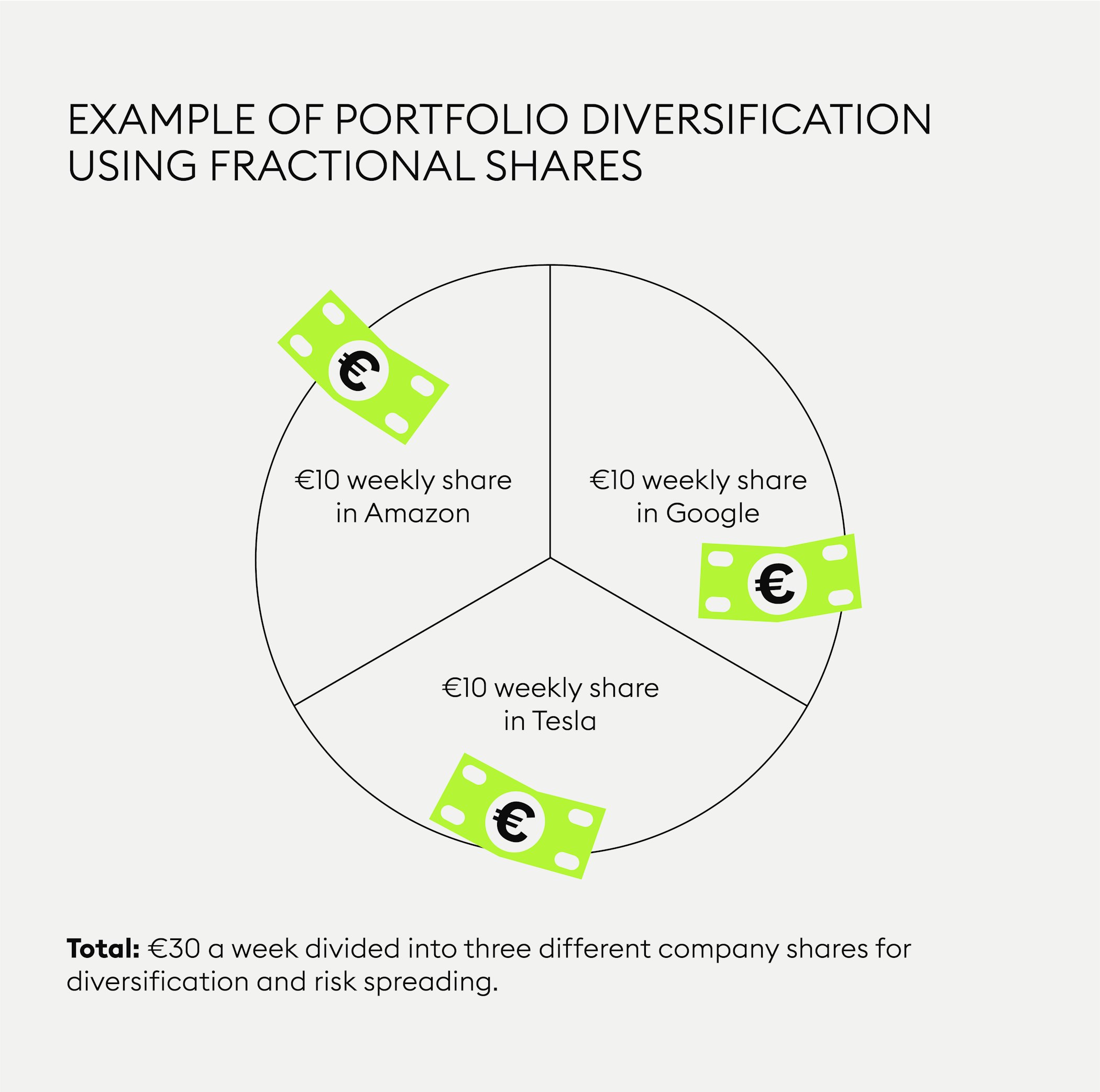

Fractional shares allow you to buy portions of multiple shares in different companies which is great for diversifying your portfolio. But the real question is: how can you make money from fractional shares? It’s true that you would undoubtedly make less than if you bought one stock instead of just a smaller portion. The trick to making money from fractional shares is to be consistent with your investments. €10 a year isn’t going to generate you much profit. However, if you invest small, regular weekly payments, you can go on a long-term cost-averaging plan that is far more likely to bring you a profit.

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.