Bitcoin ETFs explained

In recent years, spot Bitcoin ETF approval has been a target for various investment firms, hedge funds, and financial institutions since the Winklevoss Bitcoin Trust application in 2013 - but why is it so important? Although there are existing Bitcoin ETFs in the market, many observers consider the spot Bitcoin ETF approval as an integral step on Bitcoin’s journey in permeating the boundary of traditional finance into mainstream acceptance.

Let’s explore the dynamics of a spot Bitcoin ETF and analyse its potential impact in the crypto world and financial market.

What is a Bitcoin ETF?

A standard exchange-traded index fund (ETF) is made up of a wide selection of securities that have been specifically chosen to meet the objective of the investment fund. An ETF typically replicates the performance of an underlying index and offers individual investors a simple route to access the market. As there is little active fund management involved in ETFs, expenses and fees for investors are typically lower compared to mutual funds that need frequent management. Bitcoin ETFs, as you’d probably expect, track the price of Bitcoin and give investors access to the cryptocurrency without needing to directly purchase or manage BTC.

What is a spot Bitcoin ETF?

A spot Bitcoin exchange-traded fund (ETF) works similarly to a standard ETF and is an investment vehicle that allows everyday investors exposure to the price moves of Bitcoin in their regular brokerage accounts. Unlike Bitcoin futures ETFs, a spot Bitcoin ETF invests directly in Bitcoin as the underlying asset, not derivatives contracts based on their prices. Many find the idea of a spot Bitcoin ETF to be an attractive proposition as the potential improved liquidity could facilitate price stability in the wider Bitcoin market. Consequently, shining a more positive light on Bitcoin and cryptocurrency investment in general.

What does “spot” mean?

Regarding spot Bitcoin ETFs, the term “spot” simply refers to the type of ETF structure. “Spot” represents the physical asset of Bitcoin held by the fund, meaning the ETF directly possesses and tracks the activity of actual Bitcoin cryptocurrency.

You may have seen the terms spot Bitcoin ETF and Bitcoin spot ETF used interchangeably, but they are slightly different. “Spot Bitcoin ETF” follows naming conventions familiar to traditional investors that prioritise instruments and strategy. Whereas “Bitcoin spot ETF” focuses more on the digital asset class and highlights the connection to actual Bitcoin.

Ultimately, there is no fundamental functional difference between the two phrases - but now you know!

Regulatory approval for spot Bitcoin ETFs

Spot Bitcoin ETFs have been available for investment for some time in major economic powers such as Germany (BTCE - VanEck Bitcoin ETN), Canada (BTCC - Purpose Bitcoin ETF), and Brazil (QBTC11 - QR Capital Bitcoin ETF). However, the long-awaited U.S. spot Bitcoin ETF approval was only recently granted by the U.S. Securities and Exchange Commission (SEC) in January 2024. There is now strong potential for this new investment vehicle to become the go-to for mainstream cryptocurrency investments due to its simplicity and accessibility. In fact, in a 2022 Nasdaq survey of 500 financial advisors, 72% said they would be more likely to invest in crypto if a spot ETF product were offered in the U.S. Only time will tell if the spot Bitcoin ETF hits the lofty heights projected by the survey and perceived investor appetite.

Bitcoin ETNs and Bitcoin futures ETFs

While it was a slow and arduous journey to spot Bitcoin ETF regulatory approval, there are other exchange-traded products (ETPs) that have had more immediate success in this area. Bitcoin Exchange-traded notes (ETNs) have been available for investment since 2015 with ‘Bitcoin Tracker One’ (COINXBT) trading on the Nasdaq Stockholm exchange. ETNs are essentially debt notes that provide a guarantee that the specific returns generated by the index will be paid out to the investor. In the case of a Bitcoin ETN, it is based on Bitcoin's price movements and functions like an ‘IOU’ from the issuer to deliver the equivalent fiat monetary value to investors. Trust is an important component here as investors must rely on issuers to pay out the returns, so it’s vital to make sure that you are purchasing your ETNs from reputable companies with institutional-level safety and security processes.

Bitcoin futures ETFs have also been available for investment in the U.S. since ProShares Bitcoin Strategy ETF launched in October 2021. A Bitcoin futures ETF differs from a spot Bitcoin ETF because it tracks futures contracts rather than the actual Bitcoin price and therefore the value of futures indirectly follows Bitcoin's price. Let’s look at these differences in more detail.

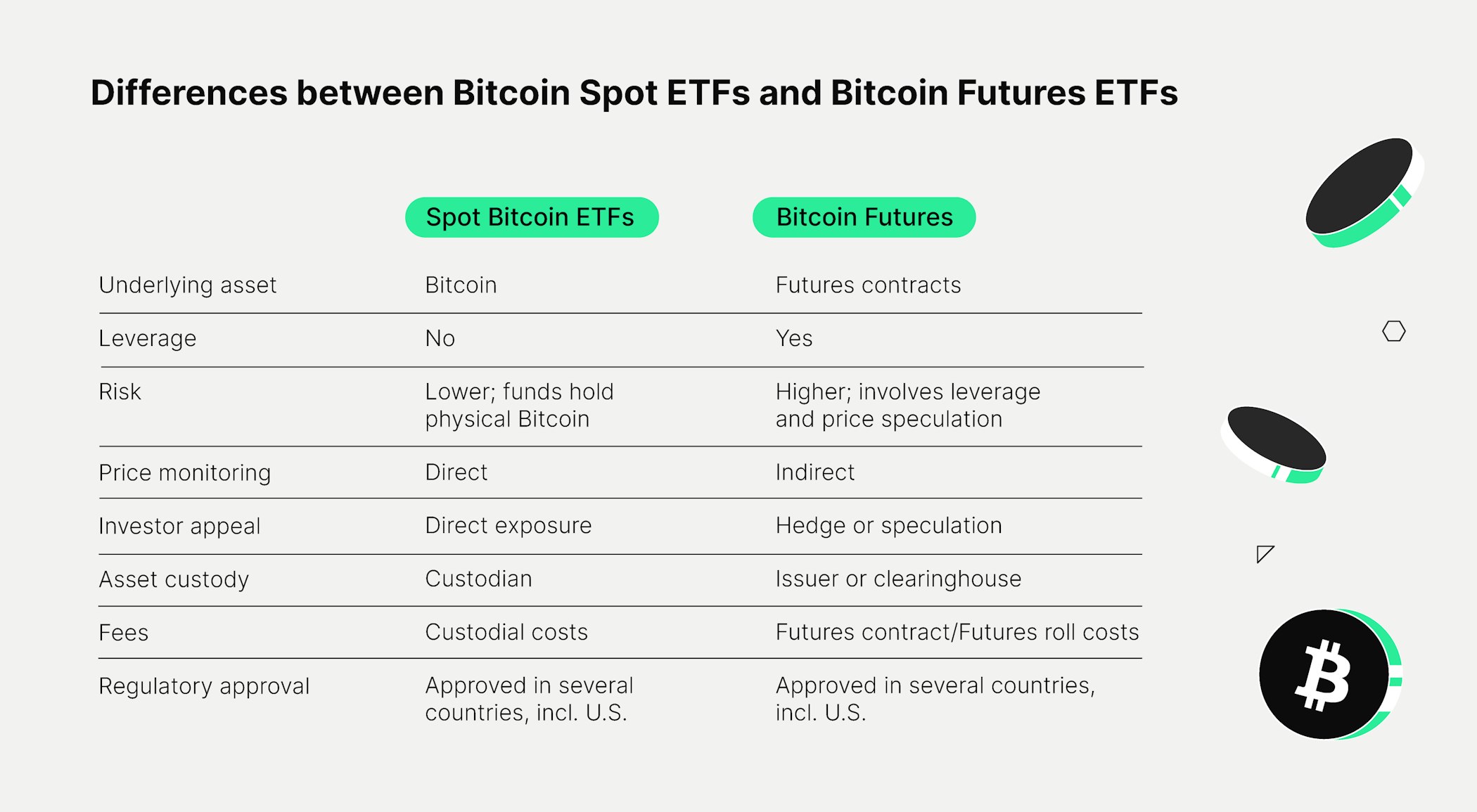

What’s the difference between spot Bitcoin ETFs and Bitcoin futures ETFs?

Though both spot ETFs and futures ETFs offer a method of investment in Bitcoin, these ETPs have fundamental differences that can vastly impact overall investment strategy and potential returns.

Spot Bitcoin ETFs

Spot Bitcoin ETFs are designed to hold actual Bitcoin, providing direct exposure to its price movements, which can be a more attractive option for traders looking for a simpler path to investing in Bitcoin. Additionally, spot ETFs can benefit investors with streamlined asset management as a custodian would hold their Bitcoin rather than the investor managing wallets and seeking their own storage solutions.

Another important aspect of spot Bitcoin ETFs is that they are structured to provide transparency in terms of the underlying assets they hold. Each portion of a spot Bitcoin ETF typically corresponds to a specific fraction of physical bitcoins held in reserve by the ETF. This structure allows investors to have high visibility into the ETF's holdings and confirmation that each share is backed by an actual quantity of Bitcoin.

While this ETP is becoming an increasingly popular option, it is also important to take into consideration the potential security risks and regulatory uncertainty as well as custodial costs and management fees for spot Bitcoin ETFs.

Bitcoin futures ETFs

Bitcoin futures ETFs track Bitcoin’s price through futures contracts that can offer experienced traders a lot of flexibility in investment strategies such as leverage or hedging. This means that traders can speculate on the Bitcoin price without actually possessing the asset itself. Futures contracts agree to buy or sell Bitcoin at a prearranged date and price based on the expected future price movements of Bitcoin.

Although Bitcoin futures ETFs can be very useful for experienced traders who have a clear strategy in mind, this ETP also comes with risks associated with the futures markets as well as issues around potential contract expiry and rollover. As futures contracts near their expiration dates, the ETF is required to engage in a process called rollover, which involves selling the expiring contract and purchasing a new one. This procedure can result in additional expenses and the possibility of tracking discrepancies.

The wider impact of spot Bitcoin ETFs

While the new spot Bitcoin ETF rollout in the U.S. may not directly affect the Bitcoin price, it could indirectly impact Bitcoin and the wider crypto market in several key ways:

Lowering the barrier to entry: Due to the technical nature of cryptocurrency, there can still be a disconnect between everyday investors and crypto adoption. Some potential buyers might be discouraged from investing in complex and unfamiliar networking technology as well as storage and security considerations. The spot Bitcoin ETF (and cryptocurrency ETFs in general) may provide a simplified and more digestible investment opportunity.

Increased crypto adoption: The spot Bitcoin ETF will likely attract substantial mainstream attention and an influx of investment from traditional investors who want a simple route to invest in Bitcoin. The surge of new traders, increased capital and fortified confidence in Bitcoin could boost Bitcoin prices and encourage new investment in other cryptocurrencies.

Reduced investment in mining companies: Bitcoin mining companies have been used as a proxy for Bitcoin investment in traditional markets. For example, similar to gold investors gaining exposure through shares of gold mining companies, potential buyers could buy shares of Bitcoin mining companies like Hive, Riot or Marathon to get exposure to Bitcoin. However, the newly approved spot Bitcoin ETF could impact mining company valuations as investors will be able to bypass mining companies and obtain direct access to the Bitcoin market.

Elevated trading activity and increased volatility: The spot Bitcoin ETF could open the door for hedge funds and speculators to actively trade Bitcoin. The increased volumes could consequently contribute to greater price volatility, as traders and market participants react to news, events, and price trends. The potential outcome could be a dynamic and active Bitcoin market with price fluctuations that offer investors more opportunities to gain profit.

Enhanced liquidity: The ETF structure would generally make Bitcoin more readily accessible to mainstream investors by removing friction for large investment funds, such as mutual funds or pensions, to allocate Bitcoin and bring substantial liquidity into the market. Furthermore, this improved liquidity can ultimately help to quell investor hesitancy and concerns about investing in Bitcoin as it would help to reduce the risk and impact of significant price swings from large trades.

The future of spot Bitcoin ETFs

As well as potentially bringing billions of dollars into the crypto market, the recent launch of the spot Bitcoin ETF in the U.S. could represent a significant step toward validating cryptocurrency as a legitimate and viable investment option for traditional financial institutions. The likely increased trading volume and enhanced liquidity could bolster the appeal of Bitcoin investment by promoting increased confidence among institutional investors, bridging the gap between the emerging cryptocurrency ecosystem and the established financial sector.

On the whole, the spot Bitcoin ETF not only signifies growing interest in cryptocurrencies but also demonstrates the continued maturation of Bitcoin as an asset class. The increased market demand and emphasis on regulatory supervision show that Bitcoin is becoming a permanent fixture in the financial landscape. Moreover, the recent spot Bitcoin ETF approval coinciding with the 2024 Bitcoin halving - an event occurring every 4 years which cuts mining rewards in half, increasing scarcity - has also drawn additional mainstream attention and provided a springboard for wider retail investor adoption. The spot Bitcoin ETF gives institutional investors an accessible entry point into the cryptocurrency space, whilst also meeting regulatory requirements by aligning with the stringent standards and compliance needs of traditional finance. Ultimately, this alignment may stimulate broader acceptance and adoption of cryptocurrencies within the institutional investment terrain.

Are you ready to buy cryptocurrencies?

Get started nowDISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.