What is Litecoin (LTC)?

The cryptocurrency Litecoin is the result of a fork in the Bitcoin source code and is therefore one of the first altcoins to be created.

In 2011, Litecoin branched off the Bitcoin source code via a fork.

Like Bitcoin, Litecoin is a peer-to-peer digital currency.

The block generation of Litecoin is faster than that of Bitcoin.

There will only ever be 84 million Litecoin, which is more than the finite supply of 21 million Bitcoin.

The Litecoin price reached its all time high of €317 in September 2021.

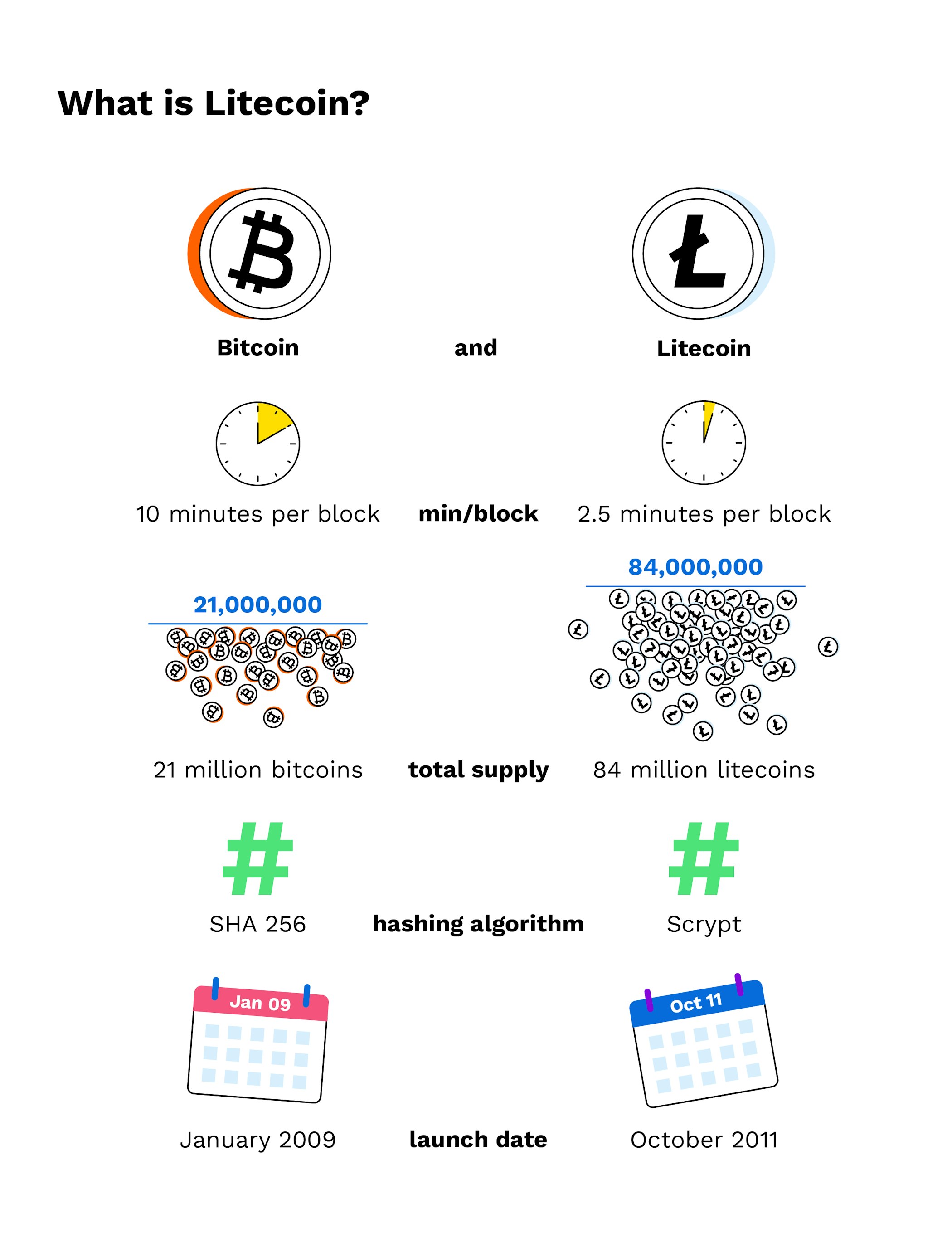

What is Litecoin?

Litecoin is a Bitcoin altcoin that was created in 2011 via a fork in the Bitcoin source code. This makes it one of the oldest cryptocurrencies in existence. Litecoin is a peer-to-peer digital currency that offers many of the same features as Bitcoin. Like Bitcoin, Litecoin is an open-source cryptocurrency that enables peer-to-peer payments without a central authority. Litecoin is also one of the biggest cryptocurrencies in terms of value, having hit a market capitalisation of $15 billion in November 2014.

What are the differences between Litecoin and Bitcoin?

One of the key differences between these cryptocurrencies is that Litecoin mining uses far more computer memory than Bitcoin in order to encourage more people to mine it. Litecoin has a block generation time of 2.5 minutes, which is significantly lower than Bitcoin’s block generation time of 10 minutes. Furthermore, the maximum number of Litecoin that can ever be produced is far greater than that of Bitcoin: 84 million for Litecoin compared to 21 million Bitcoin. Every four years Litecoin is halved, meaning that the number of Litecoin is reduced by half in order to ensure scarcity and cap inflation.

Unlike Bitcoin, whose founder remains anonymous, the creator of Litecoin, Charlie Lee, is a well-known figure in the cryptosphere who regularly attends conferences and is very active on Twitter.

What is Scrpyt?

Litecoin employs a cryptographic algorithm called Scrypt that is used for mining Litecoin. The Scrypt algorithm artificially complicates the cryptographic puzzle that has to be solved in the mining process by adding randomly generated numbers. These numbers are called “noise” and act as an additional layer of protection. Scrypt mining requires fewer resources but more memory than Bitcoin mining. Bitcoin uses the SHA-256 hash function, whereas Litecoin uses sequential memory-hard functions for maximum security against attacks.

This proof-of-work algorithm was initially introduced by the founder of Litecoin in order to offer consumer-friendly mining and to prevent the computing power in the network from becoming dependent on the financial power of network participants. He wanted to avoid Litecoin requiring expensive mining equipment like ASICs. But Scrypt-compatible ASICs equipment has been introduced to the market anyway.

New to Bitpanda? Register your account today!

Sign up hereHow does Litecoin work?

Litecoin runs on blockchain technology, which is a digital ledger where Litecoin can be securely stored and exchanged. Litecoin’s blockchain is a fork from the Bitcoin blockchain, meaning that Litecoin has its roots in the Bitcoin code.

Litecoin was the first cryptocurrency to activate SegWit (Segregated Witness), which “separates” the signature date from a transaction and then “witnesses” it for security, thus decreasing the amount of data. After the introduction of SegWit to the Litecoin protocol, Bitcoin followed suit a few months later. Consequently, Litecoin has served as a test bed for Bitcoin.

Litecoin also uses MimbleWimble, which is an innovative and highly efficient protocol that uses one multisignature for all inputs and outputs, based on “confidential transactions”. The protocol offers even further protection of privacy while greatly compressing the size of a blockchain.

How to buy Litecoin?

People who want to buy Litecoin can do so through cryptocurrency exchanges like Bitpanda using fiat currencies, e.g. euros or U.S. dollars. It’s a good idea to first get familiar with the Litecoin price history and the current exchange rate. Once purchased, your Litecoin investment can be viewed and accessed in a digital wallet that acts similarly to a banking app. You then have the option to hold on to your Litecoin or sell it again via the exchange.

What is the Litecoin price history?

Like other cryptocurrencies, Litecoin is considered to be a highly volatile asset and its price has fluctuated through many highs and lows throughout its existence. It’s important to do your own research before investing in crypto.

The price of Litecoin reached its first all time high of €305 in late 2017, followed by its standing all time high of €317 in September 2021. Currently Litecoin is experiencing a daily high of around €62.96 and a daily low of €59.88. Its current market capitalisation is €4.29B.

How to use Litecoin?

Litecoin is a digital currency that can be used for payments between peers and in some cases to pay for goods and services. It’s also an investment that can be stored in a digital wallet with the goal of its value increasing over time. Litecoin’s open-source technology, which is based on Bitcoin’s source code, also makes it a resource and inspiration for others who want to develop something similar.

Are you ready to buy cryptocurrencies?

Get started nowThis article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.