What is decentralised finance (DeFi)?

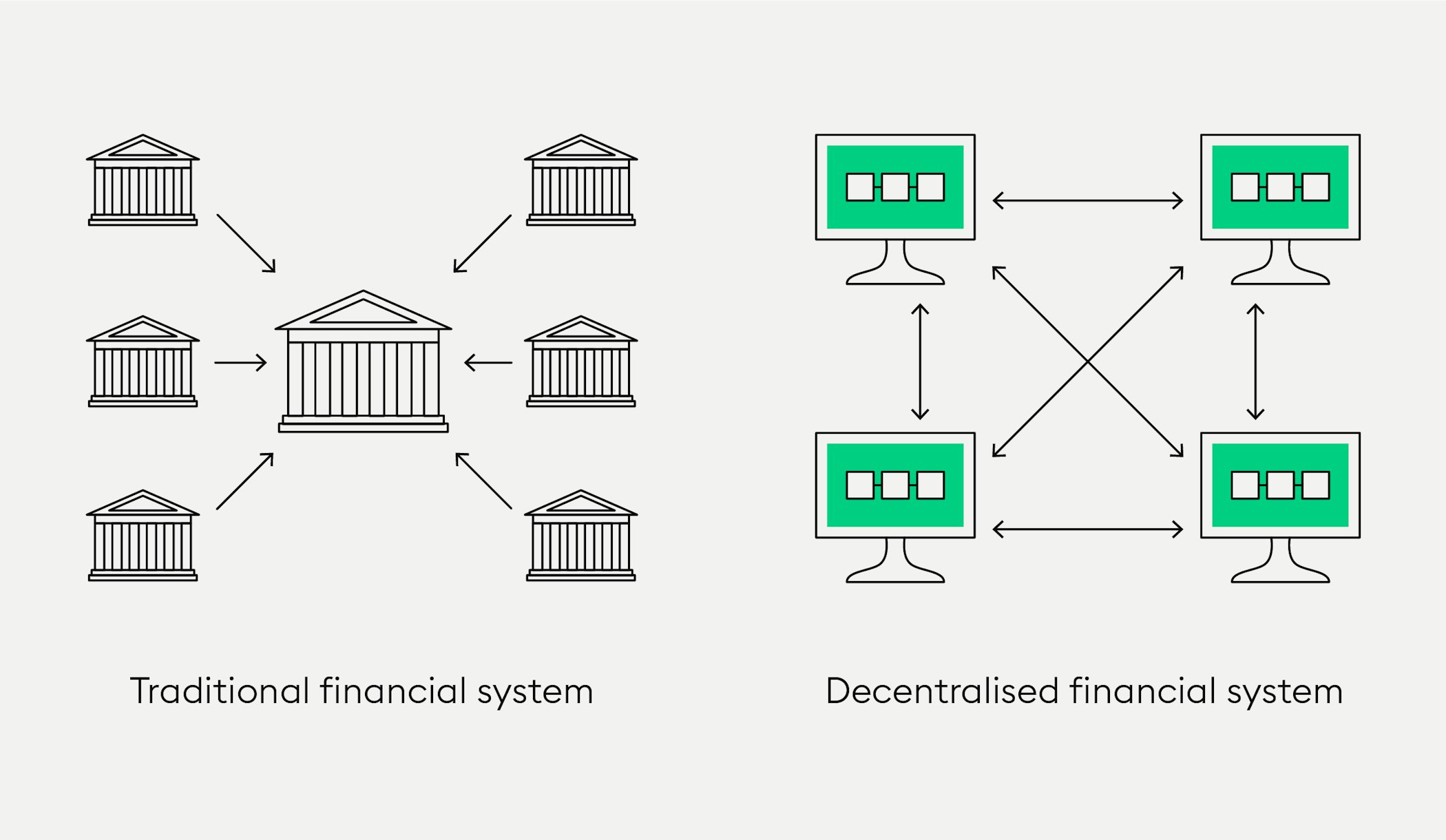

In an increasingly digital and connected world, DeFi – or decentralised finance – represents a groundbreaking movement aiming to transform traditional finance. At its core, it shifts technologies and processes like transactions into the hands of individuals to reduce dependency on central institutions.

In this guide, we’ll explain exactly what DeFi means, how it works and how you can get started in the world of decentralised finance. We’ll also explore the risks and challenges in depth, and how DeFi could reshape the traditional financial system.

Decentralised finance (DeFi) replicates traditional financial services but with a focus on transparency.

DeFi promotes financial inclusion and equality of opportunity by offering access to a global financial market without geographic restrictions or the need for a traditional bank account.

Applications aren’t managed or controlled by central authorities but are built on blockchain technology, meaning transactions occur directly between users.

Smart contracts are a core element of the DeFi sector. They encode agreements between "buyer" and "seller" directly into code, removing the need for a middleman.

DeFi, short for decentralised finance, refers to a financial application ecosystem based on blockchain technology, designed to bypass and improve traditional finance. It enables users to carry out transactions and services such as loans, exchanges and investments directly, without intermediaries. The core principles of DeFi are decentralisation, openness, accessibility and transparency. Smart contracts allow for automated agreements without central authority.

Unlike the traditional financial system, which relies on centralised institutions like banks and governments, DeFi distributes power across a network of users. This supports greater financial inclusion, enabling virtually anyone with internet access to join global financial markets. By using blockchain, DeFi offers enhanced security and transparency, as all transactions are publicly and immutably recorded.

Building blocks and infrastructure of the DeFi ecosystem

Decentralised finance, or DeFi, is made up of various key components. Together, they form an ecosystem that brings traditional financial services onto the blockchain. These components allow users to interact without central institutions, providing greater transparency, security and accessibility.

Decentralised applications (DApps)

Decentralised applications, or DApps, are the core of the DeFi ecosystem. They run on a crypto blockchain and offer users a wide range of financial services without the involvement of central authorities. By using smart contracts and DApps, automated processes such as lending, trading and investing become possible.

DApps aren’t limited to the Ethereum (ETH) protocol but are also used across other blockchain platforms, making a broad range of financial services globally accessible.

Smart contracts

Smart contracts are the central element of DeFi and enable the creation of automated agreements. These self-executing contracts are stored on the blockchain and carry out pre-defined actions once specific conditions are met, without requiring a central authority.

Their applications in DeFi are wide-ranging, from processing transactions and creating tokens to automating interest payments and conducting governance votes. Smart contracts are therefore essential for building efficient and transparent decentralised financial systems.

DeFi tokens and stablecoins

DeFi tokens and stablecoins are digital assets that play a key role in decentralised finance. DeFi tokens often serve as governance tokens within a specific DeFi project, giving holders voting rights or a share of the revenue.

Stablecoins bridge the gap to traditional finance by ensuring price stability. They're pegged to stable assets such as the US dollar, reducing the volatility common in cryptocurrencies. Both types of digital currency enable a wide range of financial transactions in DeFi, from securing loans to speculative trading.

Decentralised exchanges (DEXs)

Decentralised exchanges (DEXs) enable users to trade cryptocurrencies directly with each other, without needing a central custodian. Unlike traditional exchanges, DEXs do not hold users’ funds but use smart contracts to facilitate and secure trades.

This independence from central authorities reduces the risk of theft, censorship and downtime. DEXs are a key element of DeFi as they lay the foundation for open, accessible and secure trading of digital assets.

Decentralised lending and saving platforms

Decentralised lending and saving platforms are innovative financial tools that let users borrow, lend and earn interest on their crypto assets. These platforms use smart contracts to manage collateral and define loan terms, creating a secure and transparent environment for financial transactions.

Users can make their assets work for them by lending them out or using them as collateral. This transforms the traditional banking model and paves the way for a more inclusive financial world.

Decentralised wallets

Decentralised accounts, also known as wallets, are the gateway to participating in the DeFi ecosystem. While traditional bank accounts are controlled by central institutions, wallets give users full control over their digital assets. They operate using a combination of private and public keys – private keys authorise transactions, while public keys serve as receiving addresses.

Web3 wallets are a specialised form of decentralised wallet that also enables access to DApps. They offer high levels of security and autonomy, giving users full control over their funds while providing easy access to the global financial system without traditional banking infrastructure. Decentralised wallets are therefore the backbone of an inclusive and autonomous financial world.

With Bitpanda Web3, your entry into the decentralised internet is not only secure but also effortless. Experience a new era with smart tools that seamlessly connect traditional investing with the world of blockchain.

Explore Bitpanda Web3 - Your gateway to the future of the internet.

Get startedYour entry into the world of decentralised finance (DeFi)

DeFi opens up an exciting world full of possibilities, but it can also be overwhelming for beginners. From setting up your decentralised account – your wallet – to taking your first steps on DeFi platforms, there’s a lot to consider.

Setting up decentralised wallets

Your first step into the DeFi world is opening a decentralised account in the form of a crypto wallet. This acts like a digital purse in the blockchain world, allowing you to send, receive and store cryptocurrencies.

When choosing a wallet, make sure it’s compatible with the DeFi services you’re interested in. Security is key: note down your private key somewhere safe, and consider using a hardware wallet for larger amounts to protect your digital assets.

For more on how wallets work and how to set one up, see our guide "What is a wallet and where do I get one?"

Buying DeFi coins and tokens

Once your wallet is set up, you’re ready to buy cryptocurrencies. Ethereum (ETH) is a good place to start, as most DeFi projects are built on the Ethereum blockchain. Buying and selling coins and tokens – also known as trading – can be done via brokers or exchanges, each with their pros and cons.

Brokers like Bitpanda are usually ideal for beginners, as they act as intermediaries between investors and the market, offering services that make trading simpler and more user-friendly. Exchanges, on the other hand, enable direct trading between buyers and sellers. They tend to be more complex but offer advanced tools for experienced crypto traders.

For a more detailed introduction to trading crypto, see our guide "How do I start trading cryptocurrencies?"

New to Bitpanda? Register your account today!

Sign up hereInvesting in DeFi

With a wallet set up and your first coins and tokens secured, your real journey in the DeFi ecosystem begins. There are many ways to invest: lend your assets to earn interest, take part in crypto staking to help secure networks, or try yield farming, where assets are optimised across different protocols to maximise returns.

To invest in DeFi, start by choosing the right platform. Look for security, ease of use and the range of services offered. Well-established platforms with active communities and proven track records are a great place to begin your decentralised investment journey.

Strategies for DeFi investing

DeFi opens up new ways to invest your money independently. To make the most of its potential while managing risks, get familiar with the key strategies:

Diversification: Spread your investments across different DeFi projects and tokens to reduce risk.

Risk assessment: Carefully evaluate the specific risks of each DeFi project before investing.

Long-term perspective: Approach DeFi with a long-term outlook to benefit from sustainable growth.

Education and continuous learning: Stay up to date with developments and tech in the DeFi and crypto space so you can understand and respond to market changes.

Use of analytics tools: Leverage data tools to make informed decisions based on trends and market signals.

What are the advantages of decentralised finance (DeFi)?

DeFi offers many benefits, including broader access to financial services, the transparency and security of blockchain, full control over your money, support for innovation and flexibility, and attractive earning opportunities beyond traditional options.

Accessibility and inclusion

DeFi makes financial services available to anyone with an internet connection, regardless of geography or social status. This supports financial inclusion, especially for people without access to traditional banking.

Transparency and security

Thanks to blockchain, all DeFi transactions are public and immutable. You can track asset movements in real time and be confident that your transactions are secure and verifiable.

Autonomy and control

DeFi gives users full control over their funds. Instead of entrusting your money to a bank or other institution, you manage your own wallet. This reduces risks such as censorship, frozen accounts or unauthorised access.

Innovation and flexibility

DeFi drives financial innovation, enabling new financial products and services not possible in traditional systems. This includes automated lending and complex digital asset trading strategies.

Earning potential

DeFi platforms offer diverse income opportunities well beyond those of conventional savings. Through staking, yield farming and other mechanisms, users can earn passive income with often higher returns than traditional saving products.

Challenges and disadvantages of DeFi

While DeFi has many advantages, there are also risks and drawbacks:

Smart contract risks

Fraud in the DeFi ecosystem

Liquidity risks

High volatility

Regulatory uncertainty

Technical vulnerabilities

Smart contract risks

Smart contracts are the backbone of DeFi apps but aren’t risk-free. Bugs or security gaps can lead to major losses. To reduce risk, invest in projects whose smart contracts are regularly audited by third-party security firms. While not foolproof, audits add a layer of trust.

Fraud and scams in DeFi

DeFi isn't immune to scams, including “rug pulls” where developers disappear with users' funds. Conduct thorough due diligence before investing, and look for trustworthy community feedback to identify reliable platforms.

Liquidity risks

Liquidity issues arise when there aren’t enough funds to meet trading demands or withdrawals. Reduce this risk by investing in high-liquidity pools.

Volatility risks

Crypto prices can fluctuate significantly, directly affecting your DeFi investments. Long-term strategies and tools like stop-loss orders can help manage this risk.

Regulatory risks

DeFi regulations vary worldwide. This can create uncertainty and risk for both projects and investors. Keep up with laws and developments in your country and how they might affect your activities.

Technical risks

Advanced technologies come with technical weak spots. Wallet and platform security is crucial. Use hardware wallets and review security practices regularly to reduce risk.

Promising trends and developments in DeFi

DeFi continues to grow, with new platforms and tech that could reshape traditional finance. From Uniswap’s liquidity model to MakerDAO’s DAI stablecoin, Aave’s lending services and powerful Layer-2 solutions, DeFi is evolving fast.

Uniswap

A leader among decentralised exchanges (DEXs), Uniswap made headlines with its user-friendly interface and automated liquidity model. It enables direct swaps between Ethereum and ERC20 tokens, empowering users with full control and greater transparency.

MakerDAO

MakerDAO pioneered stablecoins with DAI, a token pegged to the US dollar. Users generate DAI by overcollateralising loans, offering a stable value in a volatile market. MakerDAO supports DeFi stability and growth by providing a trusted medium of exchange.

Aave

Aave (AAVE) is a top platform for crypto lending and borrowing. Users can earn interest or take out loans secured by their crypto. With its advanced features, Aave has opened up new strategies and added complexity to the DeFi space.

Layer-2 solutions

To solve Ethereum’s scalability and cost issues, Layer-2 solutions like Optimism (OP) and Arbitrum (ARB) are gaining ground. These process transactions off-chain to improve efficiency and speed while maintaining security. They’re crucial for scaling DeFi for wider adoption.

Are you ready to buy cryptocurrencies?

Get started nowConclusion: How to get started with decentralised finance (DeFi)

Decentralised finance (DeFi) opens the door to a revolutionary financial system defined by transparency, accessibility and autonomy. DeFi has the potential to fundamentally change the way we think about money and wealth management. It enables the delivery of innovative financial services via decentralised exchanges and lending platforms, allowing direct interaction free from traditional institutions.

As DeFi continues to grow and evolve, platforms like Uniswap, MakerDAO and Aave, supported by advanced technologies such as Layer-2 solutions, are creating new opportunities for traders and users alike. Still, it's vital to be aware of the risks and proceed with caution to enjoy the many benefits of DeFi safely.

Frequently asked questions about decentralised finance (DeFi)

Here we answer some of the most common questions on the topic of decentralised finance.

What is the significance of DeFi for the financial system?

Decentralised finance (DeFi) aims to shift technologies and processes like transactions into the hands of individuals, reducing reliance on central institutions. DeFi builds a financial system that operates without middlemen, enabling diverse financial options.

Why is decentralised finance interesting?

DeFi allows existing financial services to be reimagined in a more open, democratic and transparent way. Since 2019, it's gained increasing relevance as interest in crypto coins and tokens has surged, attracting a growing number of traders.

What is a DeFi coin or token?

A DeFi coin or token is a digital currency used within the decentralised finance system. These cryptocurrencies often represent ownership shares, voting rights in DeFi project governance, or act as payment and investment tools. They're essential for interacting with DeFi applications and services.

Which blockchain do most DeFi applications run on?

Most DeFi applications are built on the Ethereum blockchain, the leading platform for smart contracts and decentralised applications (DApps). Ethereum offers the infrastructure and security needed to support complex financial services in a decentralised setting.

More topics on DeFi

Want to expand your knowledge of decentralised finances? Check out our in-depth articles on the Bitpanda Academy for more insights into the world of digital currencies:

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.