What is an index?

An index is a measure to indicate a change in the size of values such as the price of securities over time.

Indices are used to track the price performance of securities grouped in a hypothetical portfolio representing a certain market or market segment.

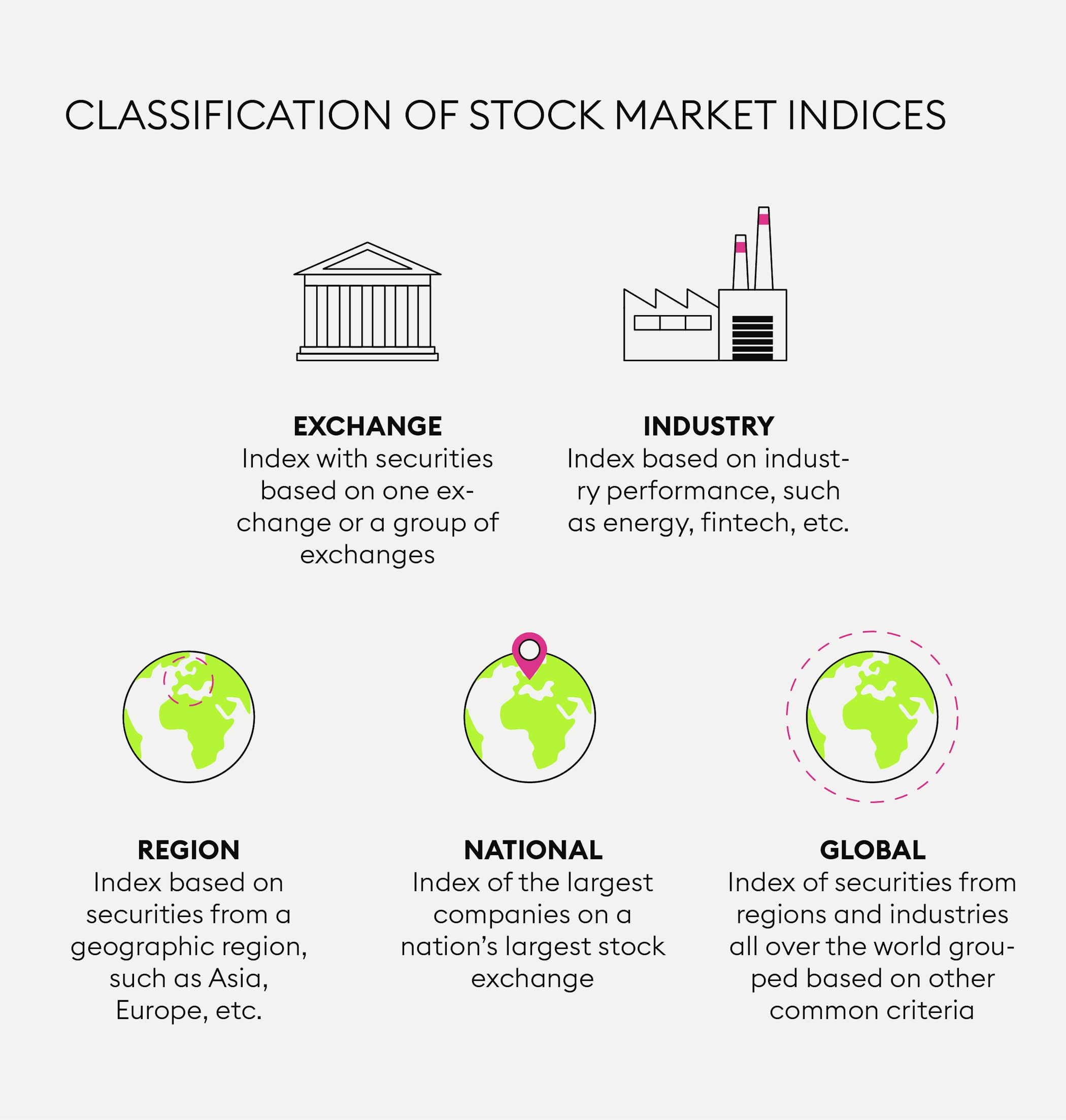

These securities may represent major titles in the stock market of a nation, an industry, or a market or a segment of a stock exchange.

Currencies, funds, commodities and bonds may also be contained in an index.

Dow Jones, S&P 500, DAX and Nikkei are a few of the most well-known indices.

When several financial assets like stocks, commodities, currencies, bonds and other securities are organised and grouped together based on certain criteria, this is called a “portfolio”. Such criteria may be a certain market (e.g. technology), a market segment (e.g. financial technology) or an asset class (e.g. stocks). Investors may also refer to all their combined assets as their “portfolio” - so generally, the term indicates a collection of securities.

To evaluate economic developments and trends for their strategy, investors need convenient tools to track the market performance of select companies and their issued securities. In certain cases, it would be much too time-consuming to analyse the underlying factors of every single publicly listed company in a market or market segment. That’s where indices come in.

What is an index?

An index is a measure to indicate a change in the size of values such as the price of securities over time. When you hear on the news that stock market prices are going up or down, this trend does not refer to a single stock. Rather, the trend refers to a measurement of a hypothetical portfolio - an index - that represents one segment of the financial markets.

The value of an index is calculated or “weighted” based on the prices of its securities or many other factors, such as market capitalisation (market cap). Investors use market indices as a tool to assess developments such as market movements and much more.

How is an index used?

As an investor, you want to watch the performance of indices that are relevant to the assets you are invested in. Tracking an index may provide you with valuable information of how your portfolio is performing, as indices provide a benchmark to compare your portfolio to.

Investors can’t invest directly in an index as it is a hypothetical basket of securities. They invest in index funds such as ETFs or mutual funds mimicking an index. Exchange-traded funds (ETFs) track a certain index and directly replicate its performance, meaning the fund will develop like the index, either in an advantageous or disadvantageous way.

New to Bitpanda? Register your account today!

Sign up hereWhat are the most famous indices?

For easier and more precise market analysis, indices are used to monitor price developments across markets and market segments. An index provides investors with a single measurement that summarises the open and close prices of a hypothetical portfolio of assets.

The oldest index in the world, the Dow Jones Industrial Average (DJIA), was established in 1896 and originally tracked twelve companies. Another well-known US index is the S&P 500 (Standard & Poor’s 500) which holds 500 of the largest US companies. The German index DAX and the Nikkei 225, Japan’s leading index, are also benchmark indices. An example of an index mentioned in financial news is: “The Dow Jones closed higher and posted small gains of 0.04%.”

DISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.