What is a savings plan?

A savings plan is, by definition, a way to regularly invest fixed amounts in specific financial products like ETFs, funds or stocks. The agreement with a bank or investment company enables investors to build wealth continuously through smaller contributions.

A savings plan is therefore ideal for investors who want to invest small amounts monthly, for example, to benefit in the long term from the performance of different asset classes. Now you already know what a savings plan is by definition. But how does a savings plan work and how can you set one up? What are the advantages and risks of a savings plan and who is it suitable for? You’ll find out all this in this guide.

A savings plan is a way to regularly invest fixed amounts in investment products like ETFs, funds or shares to build long-term wealth.

Savings plans use fixed contribution rates, automatic debits and the cost-average effect to balance out the risk of price fluctuations.

Common types of savings plans include ETF savings plans, fund savings plans, bank savings plans, share savings plans and Riester plans.

Index funds in particular are attractive for long-term savings plans as they offer broad diversification and potentially high returns.

How does a savings plan work?

A savings plan is an agreement between a bank or investment company and an investor. It works by having the investor regularly invest a fixed amount into selected financial products such as ETFs, funds or shares. This method uses fixed contribution rates to build wealth continuously over time and balance out price fluctuations.

Here's how it works in detail:

Regular investments: An investor puts a fixed sum into a savings plan at regular intervals, usually monthly.

Automatic debit: the agreed contribution is automatically withdrawn from the bank account and invested.

Cost-average effect: with consistent investments, more is bought when prices are low and less when prices are high.

Performance and reinvestment: returns such as dividends or interest can be reinvested within the savings plan.

Flexibility and adaptability: investors can adjust the contribution and intervals to match changing financial conditions.

How a savings plan works depends on the time horizon. Short-term savings plans (one to three years) focus on building capital quickly with minimal risk, often through bank savings plans. Medium-term plans (three to ten years) strike a balance between risk and return by investing in mixed or selected equity funds. Long-term savings plans (ten years or more) are ideal for wealth building and retirement planning. Index funds are particularly attractive here, offering broad diversification and high potential returns over long periods.

You should choose your savings plan based on your financial goals and desired investment horizon.

Who is a savings plan suitable for?

A savings plan is ideal for anyone looking to start with small amounts. It makes regular investing possible – even with limited funds. This allows wealth to be built gradually, step by step. Whether for retirement, saving for children, a home or a special goal: a savings plan suits many needs.

Retirement planning

A savings plan helps build wealth continuously over the long term, making it ideal for retirement. With regular contributions and the compound interest effect, investors can accumulate a substantial sum that offers financial security in later life. ETF savings plans are especially popular here as they provide broad diversification and potentially high returns.

Saving for children

A savings plan helps build early capital for children’s or grandchildren’s futures. Long-term investments create financial flexibility – for studies, a driving licence or starting a career.

Financing a property

Those looking to buy a home need equity. A savings plan supports systematic wealth building – especially for young adults and families with long-term plans.

Saving for special wishes

A savings plan is also suited to personal goals: whether it’s a world trip, a new car or a big celebration – regular contributions bring you closer to your dream, step by step.

With the Bitpanda savings plan, investing becomes easy and reliable. Invest automatically in crypto, shares, ETFs, metals, commodities* and all Bitpanda crypto indices – weekly, fortnightly or monthly. This way, you can calmly balance out the effects of short-term price fluctuations. Stay flexible: adjust your plan at any time and focus on your long-term financial goals while keeping full control of your strategy. Set up your Bitpanda savings plan today and make smarter investing simple!

Ready to build your savings? Start today with the Bitpanda Savings Plan.

Get started nowTypes of savings plans

There are various types of savings plans, each supporting different investment strategies and goals. Here are the most common:

ETF savings plan

fund savings plan

bank savings plan

share savings plan

certificate savings plan

saving with a building society contract

Each of these savings plans offers unique advantages and can be tailored to individual investment goals and risk profiles.

ETF savings plan

An ETF savings plan regularly invests in exchange-traded funds (ETFs) that track an index such as the MSCI World. These plans are popular for their low costs and broad diversification. They allow you to invest small amounts and benefit from the performance of major markets, making them ideal for long-term goals.

Fund savings plan

Fund savings plans invest in actively managed investment funds, which may include shares, bonds or real estate. You benefit from fund managers’ expertise and have a flexible option suited to different risk profiles and investment targets.

Bank savings plan

Bank savings plans are conservative options offering fixed interest, based on savings accounts. These are especially secure, as the capital isn't exposed to market risk. They're ideal for investors seeking predictable and stable returns.

Stock savings plan

A stock savings plan lets you regularly invest in individual stocks or a portfolio of shares. This allows for targeted investment in companies you believe in. While these plans offer high return potential, they also carry more risk due to dependence on company performance.

Certificate savings plan

Certificate savings plans invest in certificates that reflect underlying assets such as shares, commodities or indices. These plans can follow various strategies, like capital protection or targeted market participation, offering flexibility and the chance to seize specific market opportunities.

Saving with a building society contract

A building society contract combines regular saving with a low-interest loan for property purchase or construction. After a saving phase, you're entitled to a building loan. These are especially popular in Germany and offer a structured way to plan future property projects.

How to create a savings plan

Setting up a savings plan takes just a few steps:

Define your goals: Consider what you're saving for (e.g. retirement, property, children).

Choose suitable investment products: Decide whether to invest in ETFs, funds, shares or other securities.

Open a securities account: Select a provider and set up your account.

Set your contribution: Determine how much you want to invest monthly.

Create your savings plan: Enter your selected product and contribution in the platform.

Read the key information document: Learn about the product’s name, provider, risk and return profile.

Activate automation: Ensure monthly contributions are automatically debited from your account.

Select income option: Decide if earnings are reinvested (accumulating) or paid out (distributing).

Review regularly: Monitor your investments and adjust the plan as needed.

With the Bitpanda savings plan, you can easily set up your personal plan – either via our user-friendly platform or mobile app. You'll benefit from a wide range of ETFs, funds and other investment products that you can tailor to your needs.

New to Bitpanda? Register your account today!

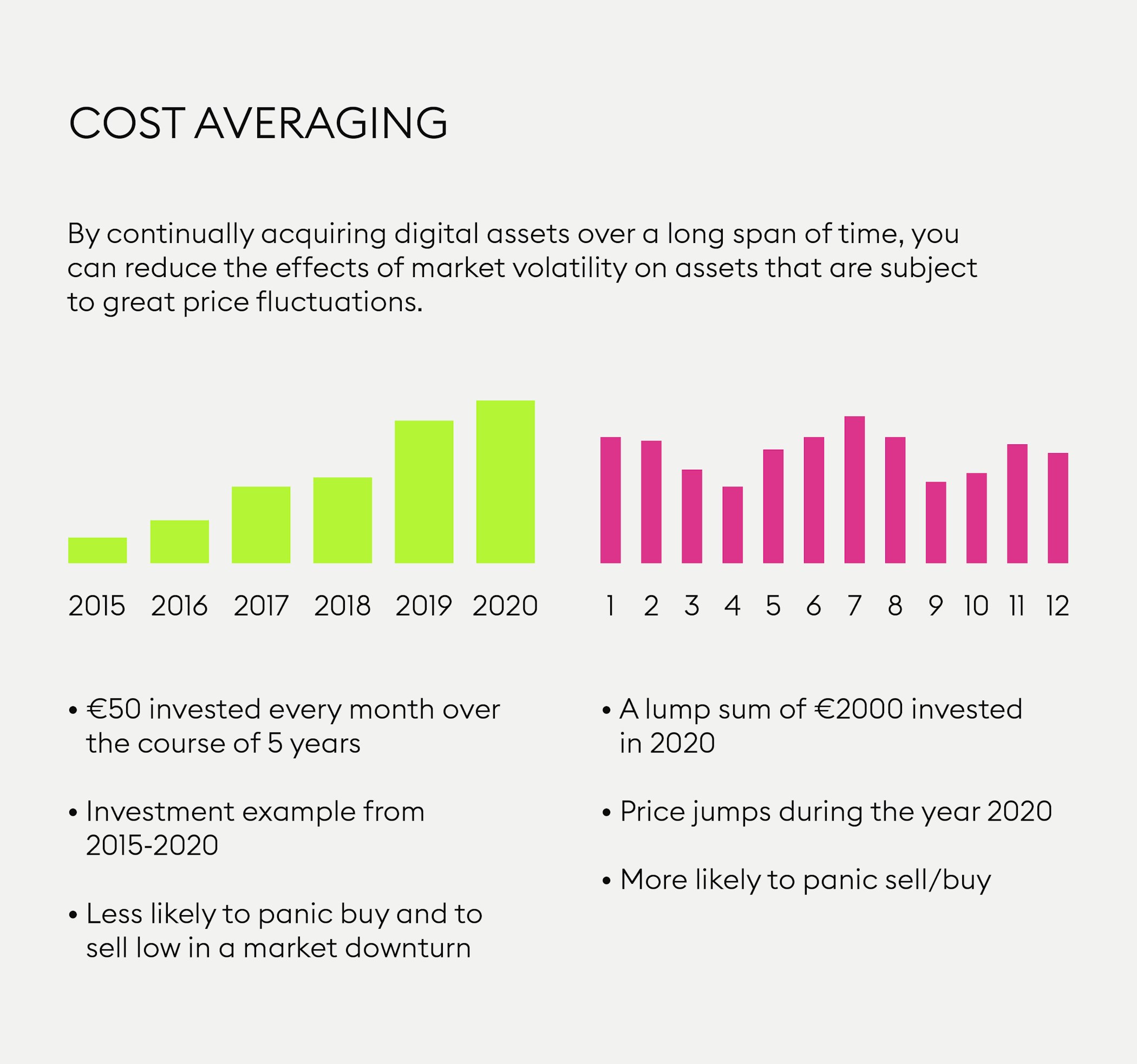

Sign up hereCost-average as the basis of a savings plan

The cost-average effect is a key strategy in savings plans. By investing a fixed amount regularly – say, monthly – you buy more units when prices are low and fewer when they're high. This lowers your average purchase price and reduces the impact of market fluctuations. It's especially beneficial with index funds, as they offer broad diversification and further spread the risk.

Example of a securities savings plan

An example of a securities savings plan might look like this:

You decide to invest €100 each month in an accumulating ETF that tracks the MSCI World Index. Every month, this amount is automatically debited from your account and invested in ETF shares. The earnings are not paid out but reinvested, which leads to greater wealth accumulation over time. Before setting up the plan, you read the ETF’s key information document to understand all important details. With regular contributions, you benefit from the cost-average effect and have a clear, automated strategy for building your wealth.

With Bitpanda, you can carry out this process easily and securely to create and manage your individual savings plan.

More topics on investing

A savings plan is just one exciting part of the investing world. Curious about how to budget for investing or what the magic triangle of investing means? You’ll find plenty to explore in our Bitpanda Academy articles.

This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.