What is investing and who can invest?

Investing for the first time can feel daunting. But with the right information and a solid plan, you can take that first step with confidence. Here are some things you might want to consider before getting started with investing.

An investment is a sum of money that is invested by a person or individual rather than a financial institution.

The general rule of thumb is that you shouldn’t invest any money that you cannot afford to lose.

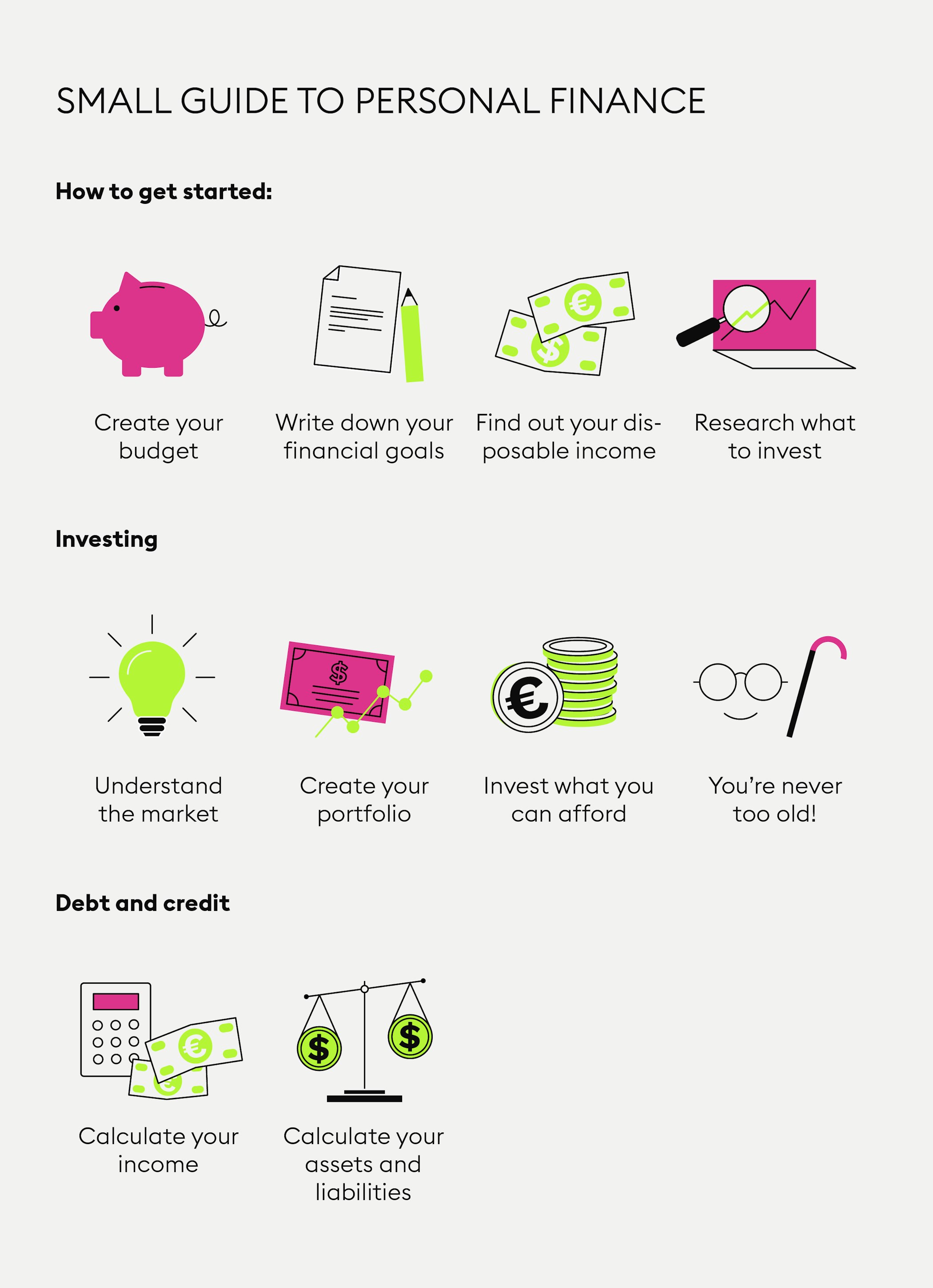

Creating a budget and asking yourself some key questions about your personal risk profile are essential to getting started.

What is investing?

Investing is the process of putting some of your (disposable) income or savings into assets like stocks, ETFs, gold or cryptocurrencies like Bitcoin. The idea behind investing is to secure your wealth and ideally end up with more money than you initially put in.

It’s up to you what you do with your investment - from how much to how little you would like to invest. However, before you invest your money in any way, there are some things you should consider in any case.

Who can invest?

Technically, if you have a bank account, you can invest. However, most investing services have a minimum age of 18 to be compliant with KYC requirements. Also, you need your parents’ permission in most countries if you are younger than 18.

On the flipside, you are never too old to invest, and it’s never too late to get started. As long as you invest steadily, wisely and keep as much money in your emergency fund as possible, you can still make a profitable income from investing.

How to prepare yourself for investing

For beginners, the general rule of thumb is that you shouldn’t invest any money that you cannot afford to lose. That is to say, don’t invest every last penny of your savings in the hope that you might see returns right away. On the contrary: never invest money in any way that would put your financial future at risk.

You should feel that you have a good relationship with your finances before you start investing. That includes making sure you don’t have any debt and keeping enough cash in your emergency savings in order to achieve financial security.

Create a budget

When starting out, make sure you have a personal and a household budget in place that shows you exactly how much money you have coming in and how much you are spending. After you have calculated your disposable income (the money that is left over after paying for bills and necessities), you can think about how much of that sum you want to invest and how much you want to allocate to savings.

Questions to ask yourself before investing

Before investing, take enough time to look at your finances, your income and expenses, and figure out how much disposable income you are able to invest and what types of investing would be best for your personal needs.

What do I want to invest in?

You have a few options: bonds, stocks, real estate and digital assets are among the most popular ones. A part of your research must go into having a general understanding of the types of markets you want to invest in. Many beginners who start off with digital assets invest in well-known cryptocurrencies like Bitcoin or Ethereum. Do your research on this, learn what kinds of things determine the price of an asset and, most importantly, how to keep your assets safe. Define for yourself how you feel about risk when investing, which brings us to the next topic: risk.

How do you feel about investment risk?

Your attitude towards risk depends on your personal situation. For example, younger people may be able to invest in assets that are considered higher risk than people who are near the age of retirement and are going to need the money from their investments when they are no longer in the workforce. The risks you want to take also depend on a lot of other factors and there is no one-size-fits-all solution.

How much should I invest?

This depends entirely on you and your income. If you don’t want to make a bulk investment, you can go with a savings plan. This is when you make small, regular (eg. weekly or monthly) investments in an asset of your choice in order to accumulate a profit in the long-term future. This is great if you want to invest but don’t want to worry about the volatility of the market.

New to Bitpanda? Register your account today!

Sign up hereThis article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.