What are assets and liabilities?

An asset is something that puts money in your pocket whereas a liability moves money out of your pocket. Understanding the difference between the two and how they interplay is one of the first steps of managing your personal finances.

An asset is something that has value and/or puts money in your pocket because it generates income and/or cash flow.

A liability moves money out of your pocket and causes costs for you.

Healthy financial planning means to increase your assets and keep your liabilities to a minimum. By budgeting a set amount of your income each month towards investing, you can begin to generate more income and assets.

What are assets?

In the broadest sense, an asset is something of value that you own and that ideally puts money in your pocket because it generates income and/or cash flow. Income is basically money you receive and is therefore important when it comes to budgeting.

Assets may appreciate in the long term, meaning that their value increases. An example of this could be a small house or some stocks that you own. However, assets may also depreciate in value, meaning they become less valuable over time, which is the case for computers or cars (unless it’s a rare vintage model).

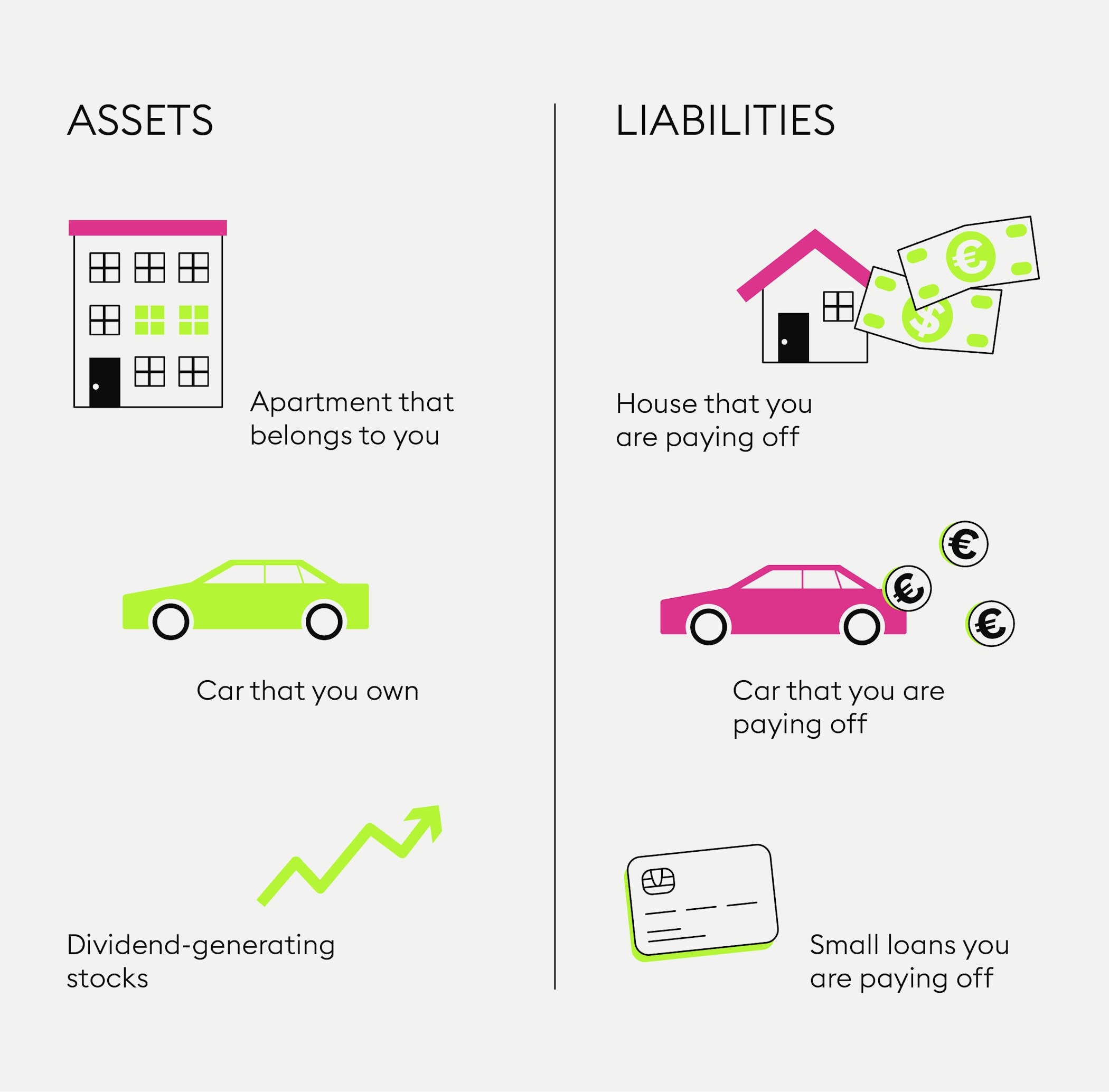

Some types of assets that generate income include dividend-paying stocks, royalties and patents. You may also find definitions of assets that include high-end items that belong to you and that you don’t owe any money for, such as your house or your car.

What is a liability?

A liability, on the other hand, moves money out of your pocket. Liabilities are things and ventures that cost you money. Liabilities don’t generate income, but create constant, regular expenses for you.

Examples of liabilities include any type of loan you are paying back, such as for real estate or student loans. But it could also be that you make use of your bank account’s overdraft on a regular basis which also causes unnecessary costs.

New to Bitpanda? Register your account today!

Sign up hereWhat do assets and liabilities have to do with budgeting and investing?

Let’s take a look at some popular misconceptions involving the concepts of assets and liabilities. Let’s say you borrowed money to buy a car. This car is now a liability for you for the duration of time you pay off the debt for your car. However, if you use your car (that has been paid off and belongs to you) to generate income by offering other people rides for money, you could then make more money than you need to upkeep the car, so it would now be considered an asset.

The same is true for real estate: In order to afford a flat or house, you take on a mortgage. This mortgage is a liability, while the real estate eventually becomes an asset when you have paid off the loan. Keep in mind though that a property and your car will keep incurring expenses such as taxes and maintenance even once you have paid off any related debt.

How to increase your assets

Your basic objective in setting up your personal financial plan is to increase your assets and keep your liabilities to a minimum. Setting up such a plan includes closely analysing your income as well as your expenses. What creates income for you and what creates expenses? How can you start generating additional income?

One way to plan for increasing your assets over time is to create an investment budget. By budgeting a set amount of your income each month towards investing, you can begin to generate more income and assets. Investing your money means that you put this money towards a cause with the expectation that this cause will generate more money (a profit) later.

Why you should become financially literate

Getting into the habit of regularly educating yourself on finance is possible at any stage in your life. Learning about finances itself is an essential investment in your financial future. Therefore, the next step after analysing your income and your expenses is to learn how to make the right financial decisions and to generate cash flow - incoming money - towards your income by investing.

This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.