What is Bitcoin Cash (BCH)?

Bitcoin Cash (BCH) is an altcoin and the result of a hard fork of the original Bitcoin blockchain. Bitcoin Cash promises faster block times and lower transaction fees compared to Bitcoin and is currently one of the 30 biggest cryptocurrencies based on market capitalisation.

The fork that resulted in Bitcoin Cash occurred due to concerns about the scalability of Bitcoin.

The Bitcoin Cash network has larger block sizes and can therefore process more transactions than Bitcoin.

Bitcoin Cash’s transaction fees are also lower than those of Bitcoin.

The Bitcoin Cash price reached its all-time high of €3,314 on 20 December, 2018

What is Bitcoin Cash?

An ongoing debate about the stability of Bitcoin led to a split of the coin on August 1st, 2017, resulting in Bitcoin Cash, a new crypto project based on the Bitcoin blockchain. The cryptocurrency issued by this blockchain is also called Bitcoin Cash (BCH).

Bitcoin Cash allows a block size of eight megabytes (compared to Bitcoin’s 1 megabyte) to increase the number of transactions that its ledger can process. Supporters of Bitcoin Cash have opted for on-chain scaling solutions such as the mentioned increase in block size, while supporters of Bitcoin (BTC) opt for off-chain scaling and second-layer solutions like the Lightning Network.

Based on market cap, Bitcoin Cash is among the top 30 largest cryptocurrencies and one of the most important altcoins to date. Still, Bitcoin Cash is not as easy to spend as Bitcoin because it does not have the same level of adoption amongst merchants.

How does Bitcoin Cash work?

Much like Bitcoin, Bitcoin Cash is a decentralised open-source network that uses a Proof of Work consensus mechanism to mine new currency and approve transactions. Miners earn Bitcoin Cash tokens as a reward for their work.

Bitcoin Cash (BCH) vs. Bitcoin (BTC)

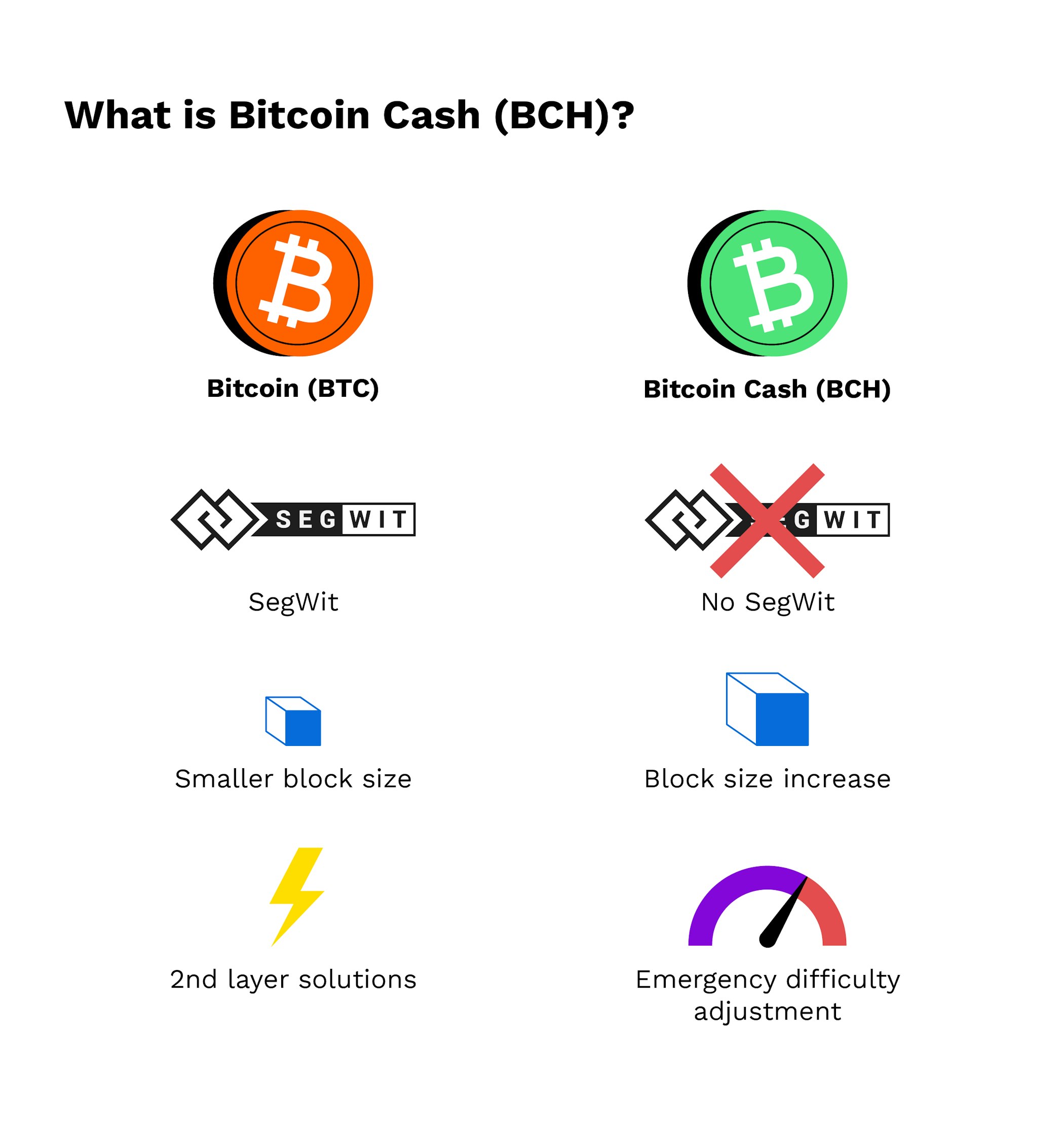

Though Bitcoin Cash is based on the Bitcoin blockchain, there are key differences between the two cryptos. With a 1 MB block size, Bitcoin is only able to process around seven transactions per second. One of the main reasons for the hard fork was that Bitcoin Cash supporters wanted a larger block size to scale up the transaction volume and speed. Bitcoin Cash, therefore, started with a block size of 8MB and has since increased that to 32MB, meaning it is now able to process over 100 transactions per second.

Another difference between the two is the transaction fees. The Bitcoin Cash network fees are lower than those of Bitcoin, averaging between $0.20 and $0.25 per transaction. Bitcoin meanwhile charges an average of $0.4 and $2 per transaction. This figure excludes the period between 2017-2018 during which Bitcoin Cash was created and Bitcoin’s transaction fees briefly rose to $55 at their height.

What further sets Bitcoin and Bitcoin Cash apart is the fact that Bitcoin Cash does not rely on the Segregated Witness Consensus Layer (SegWit) scaling solution that both Bitcoin and Litecoin, another forked Bitcoin altcoin, use to optimise transactions.

New to Bitpanda? Register your account today!

Sign up hereHow to buy Bitcoin Cash

You can buy Bitcoin Cash through cryptocurrency exchanges like Bitpanda using fiat currencies, e.g. euros or U.S. dollars. It’s a good idea to first get familiar with the Bitcoin Cash price history and the current exchange rate. Once purchased, your BCH investment can be viewed and accessed in a digital wallet similar to a banking app. You then have the option to hold on to your BCH token or sell it again via the exchange.

What is the Bitcoin Cash price history?

Like other cryptocurrencies, Bitcoin Cash is considered a highly volatile asset. Its price has fluctuated through many highs and lows throughout its existence, and there’s no way to make a guaranteed BCH price prediction. As always, it’s important to do your own research before investing in crypto.

BCH performed well when it first launched after its fork from Bitcoin, achieving an all-time trading high of €3,314 on 20 December, 2018. Since then, Bitcoin Cash has been trading under €1,000, recently taking a further dip to under €500. Currently, BCH is trading at an average daily high of €121.77 and an average daily low of €116.39. Like Bitcoin, Bitcoin Cash’s circulating supply is capped at 21 million.

How to use Bitcoin Cash?

Bitcoin Cash is designed to function like a real-world digital currency to pay for goods and services. However, it is difficult at times to find users and merchants who actually accept BCH as a currency. In the long run, Bitcoin Cash will have to focus on widespread adaptation in order to fulfil its mission. For now, the use case for BCH is similar to that of other cryptocurrencies: It can be bought, sold and traded on crypto exchanges and be held in digital wallets as part of an investment strategy.

What are the risks with Bitcoin Cash?

An increased transaction speed can have its drawbacks. In the case of Bitcoin Cash, one of them is security. A blockchain’s hashrate results from the number of attempts miners make when trying to solve a new block, e.g. how often they try to create and add a block that corresponds to the current difficulty of a blockchain. The more power consumed in a network, the higher the security of that network. Since Bitcoin consumes a lot of power in mining due to its energy-intensive Proof of Work consensus mechanism, it is considered to be more secure than other cryptocurrencies. Currently, Bitcoin Cash’s hashrate functions at about 5% of Bitcoin’s, making it potentially less secure than Bitcoin.

Are you ready to buy cryptocurrencies?

Get started nowDISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.