How to start budgeting for investing

Budgeting for investing may seem a daunting task if you have never invested before. In this article, we outline a three-point checklist to help you get it done.

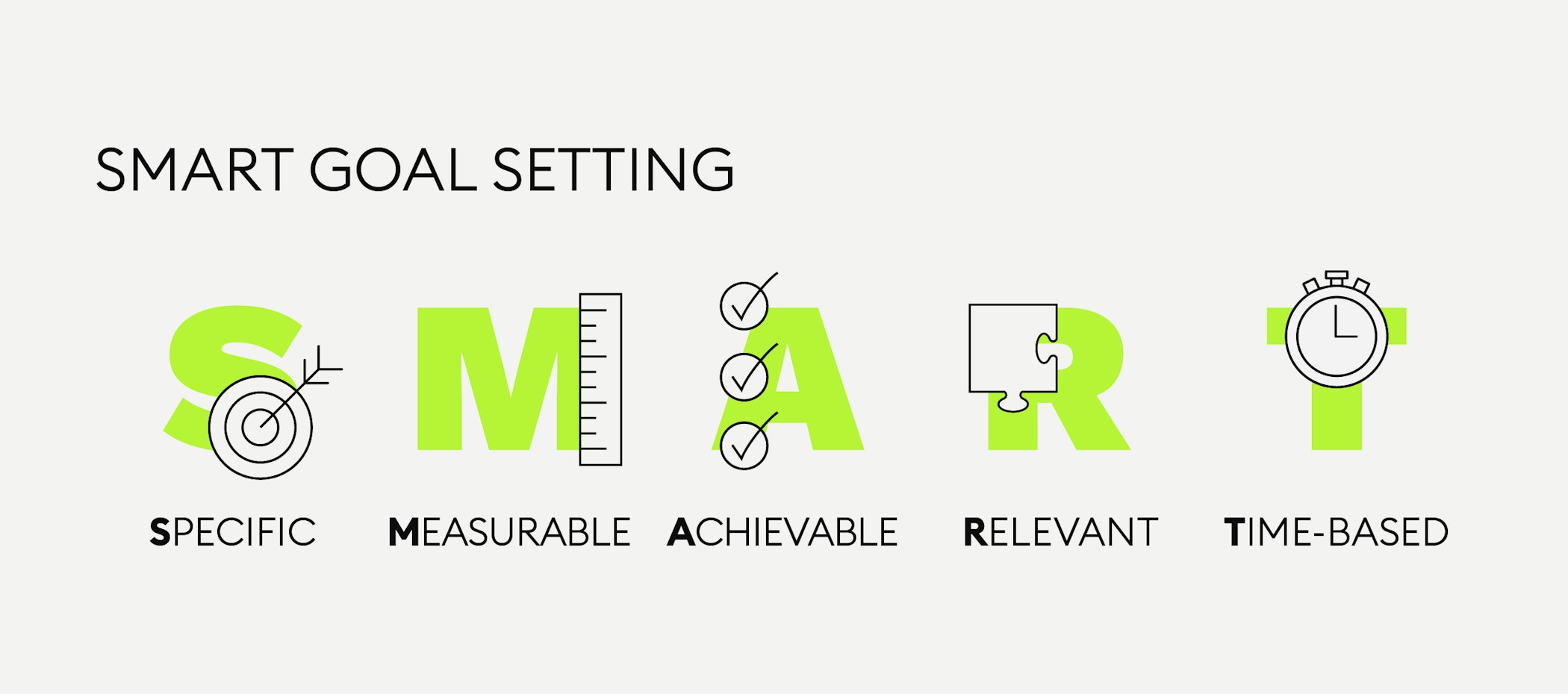

Define specific SMART financial goals.

Educate yourself on investing.

Familiarise yourself with different investment approaches.

If you’ve sorted your personal finances and have decided that you want to set aside some portion of your income for investing, then the next step is figuring out how much.

1. Create SMART investment goals

Every investor has different reasons for investing. Have you thought about why you want to invest? Do you want to invest to earn enough money to acquire a property? Or maybe you want to ensure you can comfortably retire when you are older? The reasons for investing are as numerous as the investment vehicles available to those interested in investing.

Still, it helps to clearly formulate your investment goals so that you have a strategic plan to follow. Here are a few examples for formulating investment goals using the SMART criteria for goal formulation:

Make your goal SPECIFIC. For example: “I want to have enough money to make a down payment on an apartment in the city where I live.”

Now make your goal MEASURABLE, as in “I want to have EUR 60,000 to make a down payment on an apartment in the city where I live.”

Now make your goal ACHIEVABLE - meaning it should be realistic: “I want to have EUR 60,000 to make a down payment on an apartment in the city where I live by buying large-cap stock from Dreamhousedownpaymentmaker Corp. in the city where I live.”

Now make your goal RELEVANT. Why is this goal important to you? “I want to have EUR 60,000 to make a down payment on an apartment in the city where I live by buying large-cap stock from Dreamhousedownpaymentmaker Corp so I can start a puppet-making business.”

Now make your goal TIME-BASED. Keep yourself accountable and follow through by setting a deadline: “I want to have EUR 60,000 by the year 2030 to make a down payment on an apartment in the city where I live by buying large-cap stock from Dreamhousedownpaymentmaker Corp so I can start a puppet-making business.”

2. Educate yourself on investing

Once you have formulated your SMART investment goal, the next step would be to educate yourself on the types of investments available to investors. Get familiar with the different asset types like stocks, fractional shares, bonds, ETFs etc. Understand how compound interest works and why it’s a good idea to diversify your portfolio. Bitpanda Academy has lots of information to get you started and to deepen your financial knowledge.

New to Bitpanda? Register your account today!

Sign up here3. Look into different investment approaches

Different approaches work for different investors, so it’s important to assess which investment vehicles interest you the most and whether they are suitable for your SMART goal. When making your calculations, bear a number of factors in mind:

Investing is not free, so when budgeting, don’t forget to include the fees you will be paying for setting up accounts, stock depositories, trading, transactions etc.

Also keep in mind that capital gains (profits) from investments are subject to taxation - educate yourself on the tax laws of the country you reside in.

Know your personal risk profile and be comfortable with the risk of your potential investments - historically, the lower the risk, the lower the returns and vice versa.

Take interest rates and compound interest into account.

If you’re already aware of upcoming changes to your personal circumstances, like a relocation, a job change, or anything else that might affect your financial situation, consider if and how these may affect your budget.

This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in digital assets carries risks in addition to the opportunities described above.