How do Hard and Soft Forks work?

By now, you already know that no one group has complete control over a blockchain network. Every user in a blockchain network is able to participate, as long they follow a set mechanism known as the consensus algorithm. However, what if this algorithm needs to be changed?

The consensus algorithm behind a blockchain is the foundation of a decentralised network for maintaining a public ledger of transactions without requiring a third party

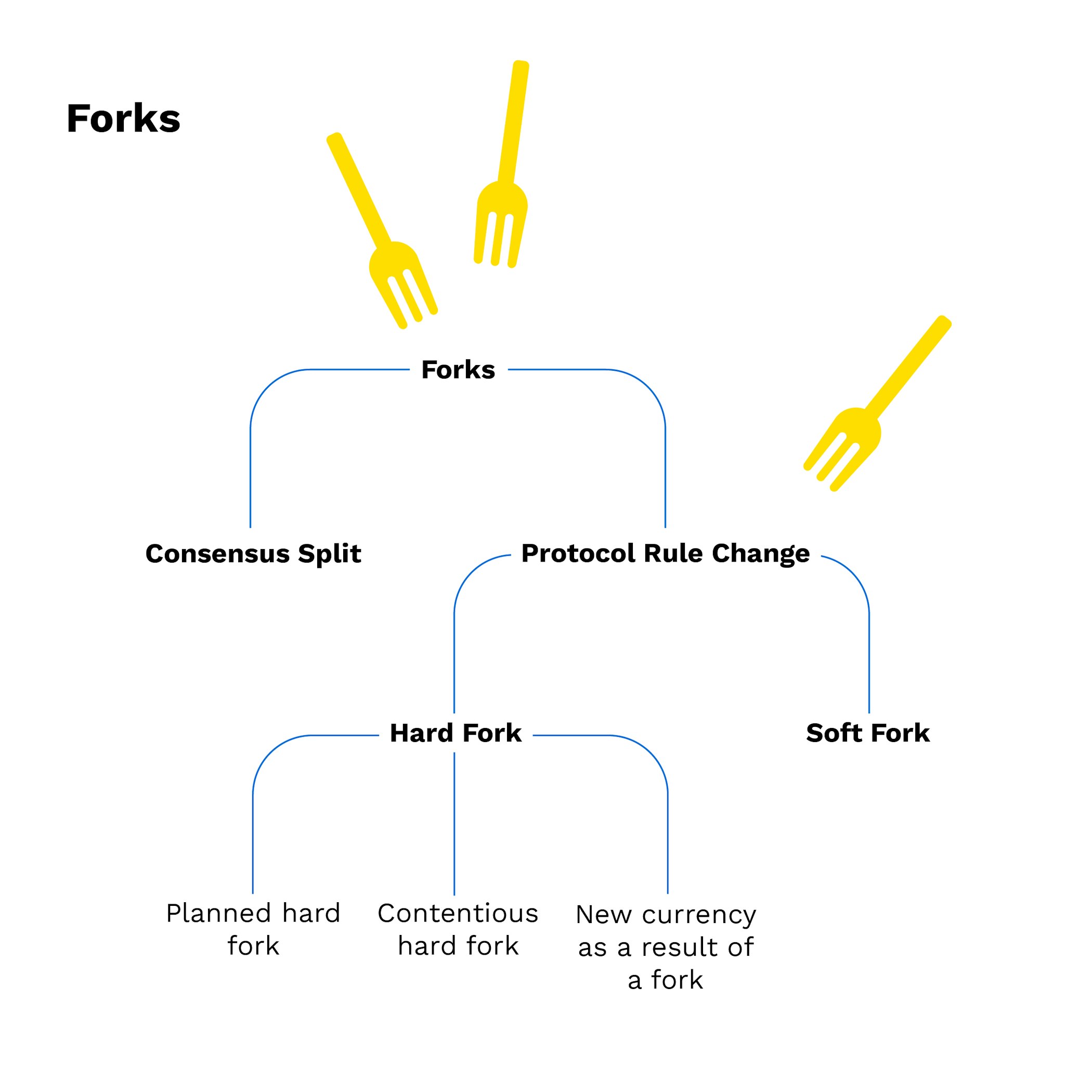

Forks result if the consensus algorithm behind a blockchain is changed

A hard fork happens if a new blockchain permanently splits from the original blockchain - all users in the network need to upgrade their software to keep participating

The Bitcoin Cash fork from the original Bitcoin blockchain is the most widely known example of a hard fork

A soft fork is a divergence that occurs if some miners still follow the old version of a blockchain while some follow the new version

Segwit was a soft fork of the Bitcoin blockchain that illustrates how a soft fork can be implemented with success, keeping the network’s status intact

In this article, you are going to learn about forks in a blockchain network.

What is a Fork?

Basically, when a blockchain splits in two, this is called a “fork”. There are several types of forks - the most important being hard fork, soft fork and temporary fork.

Both hard and soft forks are important to the continual functioning of, as well as the effective governance of the blockchain industry. In some blockchain projects, protocol upgrades in the shape of hard forks have been established from the time of project launch.

Both hard and soft forks are important to the continued functioning of, as well as the effective governance of the blockchain industry.

Forks of Bitcoin

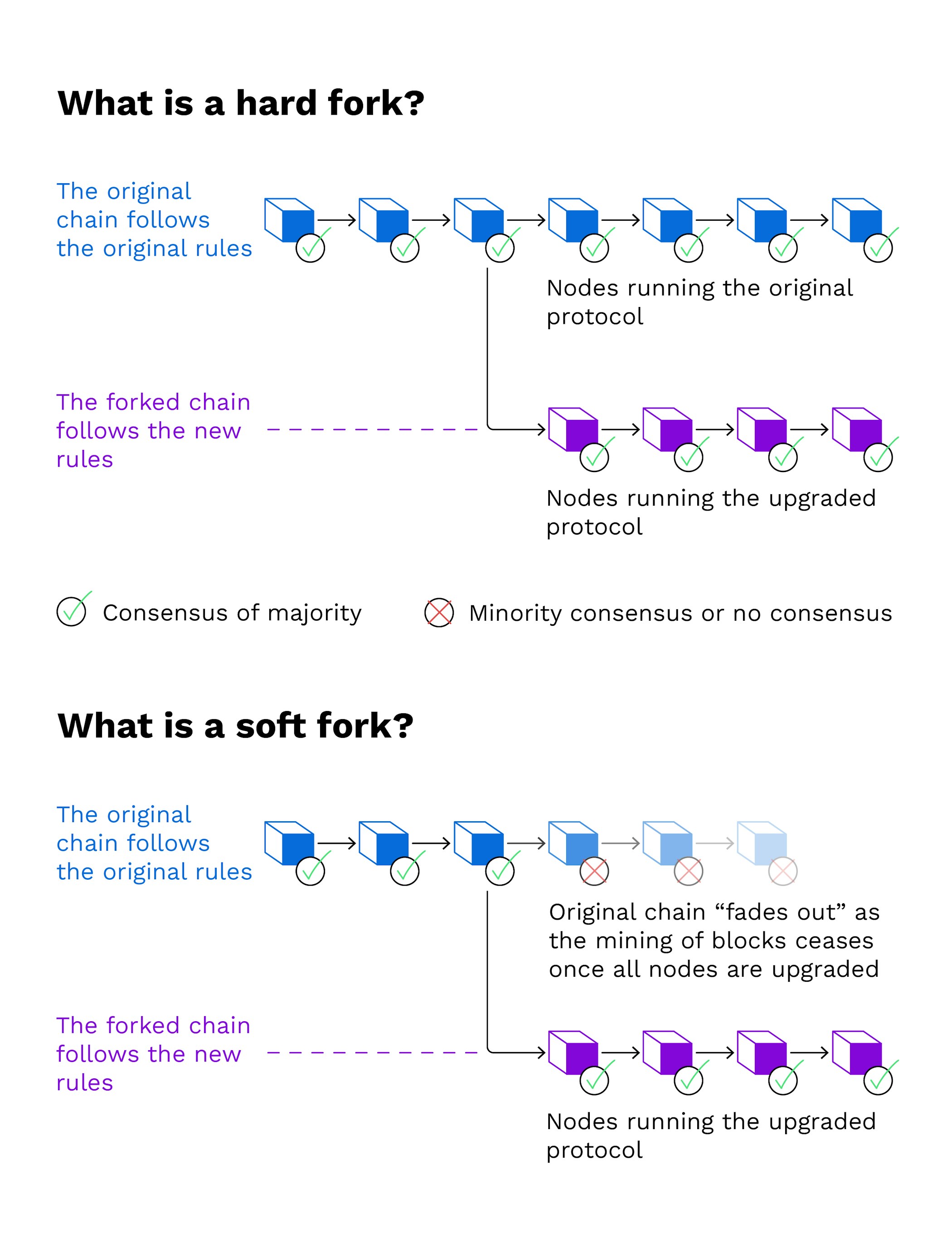

A hard fork is a protocol change that requires all network nodes to upgrade their software to the latest version to keep participating in the network. The nodes in the new version of the blockchain no longer accept the rules of the old blockchain, only the new rules. The new blockchain permanently diverges from the old version of the blockchain. Thus, a hard fork creates two blockchains that exist side by side and each blockchain has its own protocol software.

Take the example of the Bitcoin network. As Bitcoin continued to attract more users, transactions in the network became more expensive. Some community members began to examine why this was occuring. The conclusion that they came to was that Bitcoin’s process of adding blocks to its blockchain needed to be made more efficient.

A hard fork creates two blockchains that exist side by side and each blockchain has its own protocol software.

The problem was that as time went on, the entire community, including miners, developers, and regular users couldn’t seem to agree on the best solution to bring about this change. After several years of arguments, two dominant schools of thought emerged. The first idea for an update in protocol became known as “Segregated Witness”, or “SegWit” for short. Supporters of the other side believed that the best way to make Bitcoin more efficient or “scale it,” was to increase its maximum block size.

New to Bitpanda? Register your account today!

Sign up hereSegWit - a soft fork of the Bitcoin blockchain

Those who championed the proposal called “SegWit” believed that it wasn’t necessary to increase Bitcoin’s block size forever. They thought this would cause scaling issues; you would need a lot of hardware resources to run a node. More importantly, they believed in the block size limit of one megabyte which Satoshi Nakamoto had added into Bitcoin in 2010.

To keep in line with Nakamoto’s vision, this group worked on trying to find a way to allow more transactions per block while keeping the maximum block size the same and SegWit was the result. While we’ll delve into the details of SegWit further in another article, this change in protocol basically involved removing (segregating) the “witness” - data from the list of inputs which was needed to check the validity of transactions but was not needed to determine transaction effects. Thus, SegWit is a soft fork from the original Bitcoin blockchain.

The other group who wanted to scale Bitcoin disagreed. Supporters of this group felt SegWit was too complicated and contested the block size limitation. How could Bitcoin become the future dominant currency when it was averaging seven transactions per second? Why not just increase the block size and let the network handle more? As the groups were unable to agree on how to proceed, thus the final result was what is called a “contentious” fork.

A contentious hard fork - Bitcoin Cash (BCH)

On August 1, 2017, the Bitcoin network hard-forked, meaning that some users sided with the SegWit group and others sided with the block size group. As a result, the Bitcoin blockchain split in two: the original Bitcoin blockchain implemented SegWit and the block size group supported the emergence of Bitcoin Cash, which has since evolved into one of the most important altcoins. Therefore, Bitcoin Cash is a hard fork from the original Bitcoin blockchain.

Temporary Fork

The third type of fork is a circumstance inherent in a Proof of Work mining process. In this situation, two miners in a network discover a block at the same time, the blockchain temporarily splits into two competing blockchains. In this case, the longest blockchain is regarded as the “true” blockchain and the shorter blockchain is abandoned.

Spin-off coins

Spin-off coins are created on an existing cryptocurrency’s open source code in order to create a new currency project with new features, such as Litecoin.

Differences between a Hard Fork and Soft Fork

The main difference between a hard fork and a soft fork is how necessary it is to update node software in order to continue participating in the network. The nodes in the new version of the blockchain accept the rules of the old blockchain for a certain amount of time, along with the new rules and the network maintains an old version while the new version is created.

The main difference between a hard fork and soft fork is essentially that the change in protocol is gradual.

After the implementation of a soft fork, users who have full copies of the blockchain in question can follow both the old and the new rules up to a point, rendering this blockchain “backwards compatible”. Miners, who are the key to a successful soft fork as well, decide how long this period lasts. The final result is one new valid blockchain with only the majority of the miners needing to upgrade their software.

The challenges of forks

Some argue that hard forks pose a threat to the maintenance of the predictability and stability of networks that are essential for the adoption of cryptocurrencies to daily financial transactions. Power struggles involving contentious hard forks may confuse users and result in loss of funds in case users send funds to the wrong network. On the other hand, forks afford a network the chance to audit itself and to add increased features such as scaling functionalities to existing cryptocurrencies, which are equally essential for adoption. All in all, the challenge lies more in the execution of the event than the principle itself. Therefore, effective governance processes are a prerequisite in any case.

Are you ready to buy cryptocurrencies?

Get started nowDISCLAIMER

This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.

None of the Bitpanda GmbH nor any of its affiliates, advisors or representatives shall have any liability whatsoever arising in connection with this article.

Please note that an investment in crypto assets carries risks in addition to the opportunities described above.